PPG Industries Inc. (PPG) is one of the world’s largest paints and coatings companies. Higher input costs are going to impact it, along with the rest of the industry, but price increases throughout the business were only partially offset by volume decreases. This shows that PPG remains a top pick among customers even if realized prices are higher, explains Ben Reynolds, editor of Sure Passive Income.

PPG Industries was founded in 1883 and today has operations in more than 70 countries. It reported fourth-quarter and full year results on January 19th, 2023.

For the quarter, revenue of $4.2 billion matched the prior year’s result, but beat estimates by $70 million. Adjusted earnings-per-share of $1.22 were down slightly from $1.26 in the prior year but were $0.09 above expectations. For the year, revenue improved 5.4% to a record $17.7 billion while adjusted earnings-per-share of $6.05 were down from $6.77 in 2021.

Organic growth was 8% for the quarter as higher prices offset a 5% decline in volume. Performance Coatings fell 1% to $2.49 billion as currency exchange and lower volumes offset increased realized prices. Industrial Coatings grew 1% to $1.7 billion, mostly due to higher prices. Automotive and Aerospace demand improved throughout the company. We forecast PPG Industries will earn $6.99 in 2023, representing an increase of 15.5% compared to 2022.

PPG Industries has a dominant market position in its industry as customers have come to know and trust its paints and coatings. This has been reflected in the company’s ability to increase product prices without seeing a dramatic decline in volume.

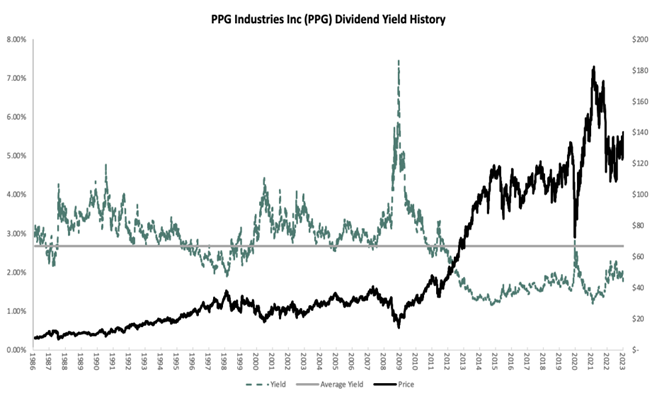

The company also raised its dividend 4.9% from 2007 to 2009. On July 21st, 2022, PPG Industries raised its dividend 5.1%, extending the company’s dividend growth streak to 51 consecutive years. This qualifies the company as a Dividend King. The projected payout ratio for 2023 is just 35%. The stock offers a yield of 1.8%.

PPG Industries’ leadership position in its industry has powered its earnings-per-share growth. It had a compound annual growth rate of 4.3% over the last decade, but growth has slowed 3.5% over the past five years. That being said, we continue to believe that PPG Industries can grow earnings-per-share at a rate of 8% annually through 2028 as demand rebounds from the COVID-19 lows.

Recommended Action: Buy PPG.