When excessive optimism is broadly replaced with overwhelming pessimism, there will be investment opportunities…but you have to do your homework. The Netflix (NFLX) saga is a great example, writes Berna Barshay, editor of HedgeFundGirl.

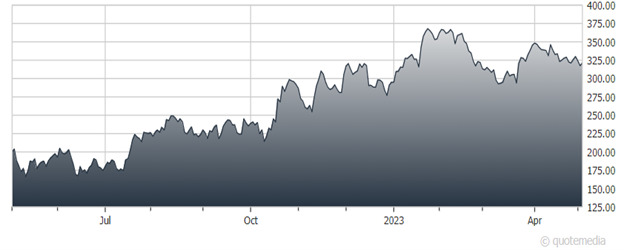

April 20 marked the one-year anniversary of the NFLX earnings miss that sent the stock reeling 35% in a day, kicking off a drop that would leave NFLX shares decimated. By mid-May 2022, NFLX shares would hit a low of $166.37, completing a massive 76% drop from the November 2021 high of $691.69.

Schadenfreude reigned as Netflix lost subscribers from one quarter to the next, for the first time in memory, causing investor panic. The dream of an endless runway for growth died with that quarter, and the stock plummeted even as it started to finally turn the corner on free cash flow generation.

Indeed, that Netflix quarter was the moment that changed everything for streaming. Growth investors’ endless tolerance for cash burn abruptly ended that day, along with their belief in the myth of a nearly infinite Total Addressable Market (TAM) for Netflix.

Ironically, the moment when so many investors lost faith in Netflix coincided with the one that made me - and I am sure many other value investors - consider the stock for the first time. On May 9, 2022, I made a presentation at the MoneyShow Las Vegas – an investing conference for retail investors – making the bull case for Netflix.

My bull case had four main points:

- Netflix was still the undisputed streaming leader in terms of size and global scale.

- Then Co-CEOs Reed Hastings and Ted Sarandos comprised the longest-running and best executing management team in the business.

- A then newly announced lower-priced, ad-supported service represented a major growth opportunity for Netflix.

- Valuation was reasonable and investor expectations were no longer unrealistic, which de-risked the trade.

NFLX shares bottomed on May 11, 2022, two days after my presentation. Based on the 5/1/2023 closing price of $324.12, NFLX shares are up 95% in just under a year, versus the S&P 500 up just 6% in the same time period.

Netflix Inc. (NFLX)

I’m not going to do a full re-hash of Netflix’s recently released first quarter results. Suffice to say, the first quarter was in-line with expectations, but the second quarter guidance was decidedly soft. Netflix did raise its full year 2023 free cash flow guidance from $3 billion to $3.5 billion, which is always something I like to see.

With the stock having nearly doubled, sentiment has obviously improved regarding Netflix – although there are plenty of vocal bears still out there. Valuation is also nowhere near as attractive as it was this time last year. But though I trimmed half of my position in NFLX shares during the first quarter, I still have conviction in the bullet points above.

Recommended Action: Stick with NFLX.