Not long ago, “cash is trash” was a common theme as savings accounts yielded zero. But now the Federal Reserve faces a new problem: Surging money market balances. There are TWO possible outcomes from here, which are not good, outlines Lance Roberts, editor of The Bull Bear Report.

Following the “financial crisis” the Federal Reserve hoped that inflating asset prices would trickle down into economic growth. Given the economy is driven by “consumption,” the Fed believed that promoting “asset inflation” would lead to increased “confidence,” thereby creating economic growth. Such was the exact point made in 2010 by Ben Bernanke.

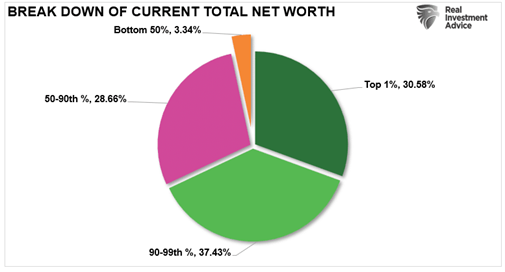

Unfortunately, the result was not as advertised. Instead, economic growth stagnated, and the wealth gap exploded. To put this in better perspective, the top 10% of households now control 68% of all wealth. The following 40% have 29%, with the bottom 50% owning just 3%.

This data makes it easy to understand why there is such an outcry for socialism today. It also leaves the Fed with a choice between two evils...

- Powell & Co. reverse rates to zero. As aging demographics strain the pension and social welfare systems, the debt will continue to stifle inflation and economic growth. The cycle that started nearly 40 years ago will continue as the U.S. adopts the “Japan Syndrome.”

- The second outcome is far worse, an economic decoupling that leads to a massive deleveraging process. That event started in 2008 but was cut short by Central Bank interventions. In 2020, the Fed arrested the deleveraging process once again. Both events led to an even more debt-laden system.

We now know that surging debt and deficits inhibit organic growth. The massive debt levels added to the backs of taxpayers will only ensure the Fed will eventually get forced back to zero bounds.

While taking risks is no longer necessary given current yields on money markets, if you are a saver, I would suggest locking in rates sooner than later. History is pretty clear about future outcomes from the Fed’s current actions.

Supporting economic growth through increasing debt levels only makes sense if “growth at all costs” uniformly benefits all citizens. Unfortunately, we are finding a big difference between growth and prosperity.

An inflation policy that minimizes concern for debt burdens while accelerating the growth of those burdens is taking a severe toll on economic and social stability.