In baseball parlance, Bluebird Bio (BLUE) would be a clean-up hitter, which is typically a big slugger that is as likely to strike out as he is to hit a home run, asserts Jimmy Mengel, editor of The Profit Sector.

This type of home run hitter would fit into the category of high-risk investments like crypto, biotech, and junior miners. You need to be able to tolerate the risk of losing it all — or hitting a moonshot.

For a home run hitter, we need to look at small-cap stocks. Let’s slot Bluebird Bio into our clean-up spot. Bluebird is a clinical-stage biotechnology company, a sector that is notoriously sink-or-swim. It’s relatively tiny, with a market cap of just $323 million.

Bluebird’s focus is on gene therapy research and development, which is an emerging field just entering the public’s purview. It involves the genetic modification of cells in order to prevent or treat disease by repairing defective genetic material.

It’s the stuff of science fiction, and that’s why investing in this space is a risky maneuver. A company would have to clear several regulatory hurdles and pass a number of trials to get its products to market.

And it could take quite a bit of time…

The key to short-term investing in industries like this is the trials. When a company hits on a trial, the stock rallies big time. When it misses, the opposite is true. As far as gene therapy goes, these trials have been going on for decades now — from 1989 to 2018, there were over 2,900 clinical trials, half of them only reaching phase I.

It wasn’t until 2003 that the first gene therapy company got regulatory approval. However, that’s why Bluebird could be a home run in the near future. They lost over 50% of their share price. That’s the world of small biotechs taking on some of the most important and difficult problems in the world.

I’d say if you want to take a swing at something, Bluebird has the research team, the cash, and the name recognition to pull off a successful trial or two. It doesn’t hurt that the company is pursuing some very rare disorders that cost an absolute fortune to treat.

Bluebird’s treatment for TDT — a very rare blood disorder — Zynteglo, was approved last summer and had the controversial title of the most expensive treatment in history at $2.8 million.

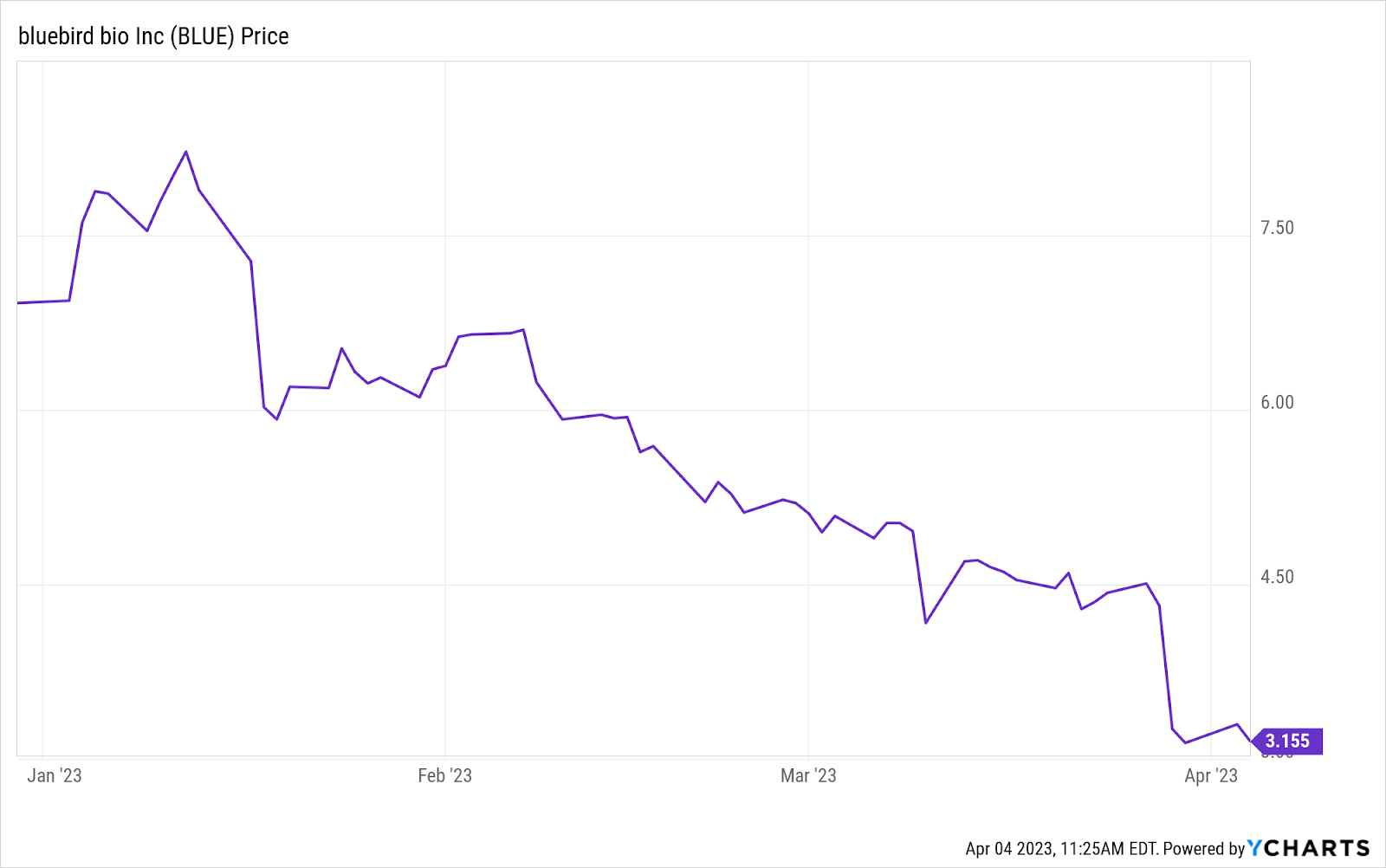

After the approval, the stock shot up almost 50% in less than a week. That’s a heck of a return in a couple of days, but look at what the company has done since the beginning of the year:

That is despite the fact that Bluebird was also able to beat their own record for the most expensive drug in the world when Skysona — a treatment for the neurodegenerative disease CALD (cerebral adrenoleukodystrophy) was approved. That drug goes for $3 million. While those two approvals sent the stock soaring, the market is much more of the “what have you done for me lately” type.

As far as Bluebird goes, it appears that those two drugs alone will start to pay off big time. The company is anticipating up to 1,500 patients with Zynteglo and another 50 patients with Skysona. That would add up to billions of dollars when they start posting financial reports next year — another catalyst for small biotechs like this.

I’d be buying on the recent dip in anticipation of the company beating revenue over the next year. But heed my warning — companies like Bluebird could end up in a situation, where they hit two big slams, get attention and a big contract, and immediately begin striking out half of the time going forward. Make sure you have a balanced lineup if you seriously want to compete in this market and against the competition for years to come.