Gold got slammed on Friday, and it fell again earlier this week. But the bull run is still intact, and it’s important to remain focused on the big-picture fundamentals that demand far higher gold prices. One chart above all others perfectly summarizes that story, writes Brien Lundin, editor of Gold Newsletter.

It usually takes gold a few tries to get over “big numbers.” Obviously, there can be few numbers bigger than $2,000 — and gold continues to mount assaults on that key level.

And I’m not just talking about the last couple of weeks. As you can see from this chart, this is gold’s third attempt to break through $2,000 over the past few years.

But the chart above isn’t why I’m writing you today. Because there’s one other chart that fully captures the current moment in human history...shows that we’re in the end game of a multi-decade trend...and virtually guarantees far higher prices for gold.

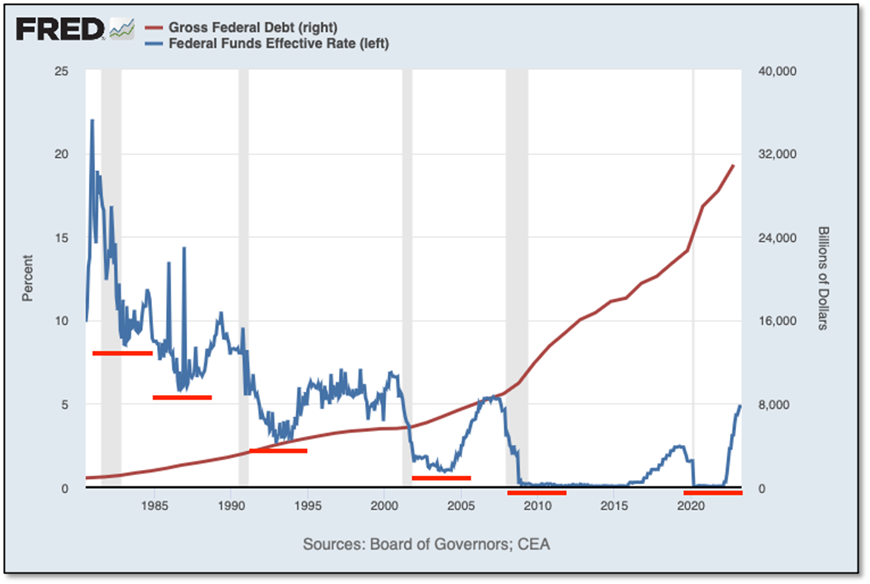

What you see here is a multi-decade trend dating back to 1980, when Fed Chairman Paul Volcker began to bring interest rates back down from their historic highs.

Volcker had shown great courage in tanking the economy to kill off inflation. But that said, we need to remember that the federal debt was just 35% of GDP back then, as opposed to about 125% of GDP today.

That illustrates the trap that Jerome Powell and the FOMC find themselves in today. With debt this high, they simply can’t raise rates to levels sufficient to knock out inflation.

Which brings me back to our chart. As you can see, after Volcker began to lower rates, every succeeding Fed chairman resorted to the same recipe for resuscitating the economy: They lowered interest rates.

Sounds fine, but as the years and decades passed, this policy increasingly became a crutch for whatever ailed the economy...and the markets began to expect it.

Thus, before the Fed could normalize rates back to the old range, increasingly addicted financial and investment markets would throw hissy fits, forcing the Fed to back track.

I’ve also added a line showing the consequence of these ever-lower rates: the debt accumulation that they encouraged. When money is ever-cheaper, it pays to take on ever-greater levels of debt. And thus, this side-effect has created the very conditions that will prevent rates from ever rising again.

With the federal debt now approaching $32 trillion, we’ll soon be paying over $1 trillion every year just to service that debt. And if the Fed’s predictions hold true, they’ll get rates even higher...and the debt-service costs will rise toward $2 trillion.

But they’ll never get there.

That’s because we’re locked into a situation in which interest rates can never rise above the rate of inflation, or the debt pyramid will simply collapse.

The end result of all of this is that the purchasing power of the dollar will begin falling at an ever-increasing rate...And the price of gold will correspondingly soar.