In The Edge Group’s analysis of corporate break-ups or spinoffs in the U.S. and Europe over the past decade, we observed that on the completion of these break-ups, several parent and spinoffs post-spin were acquired/merged with other businesses. Cerence (CRNC) could be one that gets taken over, notes Jim Osman, editor of The Edge Spinoff Report Lite.

The Edge identified 119 takeover transactions, accounting for 18% of the total companies; with the takeover probability of roughly two out of ten transactions. We highlighted three potential near-term takeover candidates in our The Spinoff Manual: Takeover Findings study published on Feb 9, 2022, and we arrived at another takeover idea, CRNC, based on our screening process.

We believe there are a number of factors pointing toward a potential acquisition of the AI-powered virtual assistant company CRNC (on top of our takeover data), including:

(i) Prior interest in acquiring NUAN and parts of the business like CRNC back in 2013. NUAN was eventually acquired by Microsoft (MSFT) in Q1 2022

(ii) Potential suitors like Continental AG (CTTAY), which is looking to secure its long-term tech mobility market position, or Samsung (via subsidiary Harman), a customer of CRNC previously rumored to buy NUAN in 2014

(iii) A newly appointed CFO who knows CRNC and has a track record of takeovers

(iv) An activist on the shareholders list

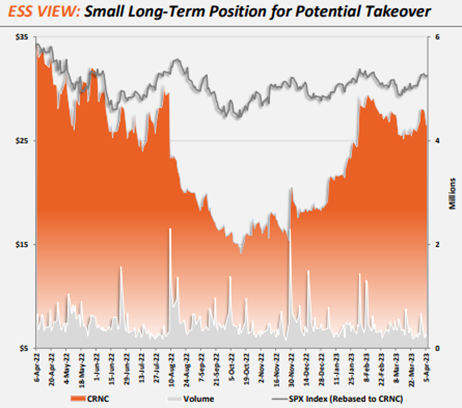

We recommend a small long-term position for a potential takeover play over the next 6-12 months. Upside Potential: +33% (Base Case) and +75% (Bull Case).

Recommended Action: Buy CRNC.