People ask me all the time if internal combustion engines are going away. I don't think so, and Warren Buffett doesn't either — at least not any time soon. But as the energy industry increasingly focuses on renewables, the First Trust Global Wind Energy ETF (FAN) looks more and more attractive, advises Tony Sagami, editor of Weiss Ratings Daily.

Warren Buffett's Berkshire Hathaway (BRK.A) just purchased 3.7 million shares of Occidental Petroleum (OXY) for $216 million. That's not his first purchase of OXY stock, either. Berkshire Hathaway now owns 211.7 million shares, worth about $12.6 billion, and OXY is now its seventh largest holding.

I'm only half as smart — maybe less — as Buffett, but he clearly believes the fossil fuel business has a bright, prosperous future. Yet that does not mean you should load up on fossil fuel stocks. In fact, I think there is even more opportunity in renewable energy stocks.

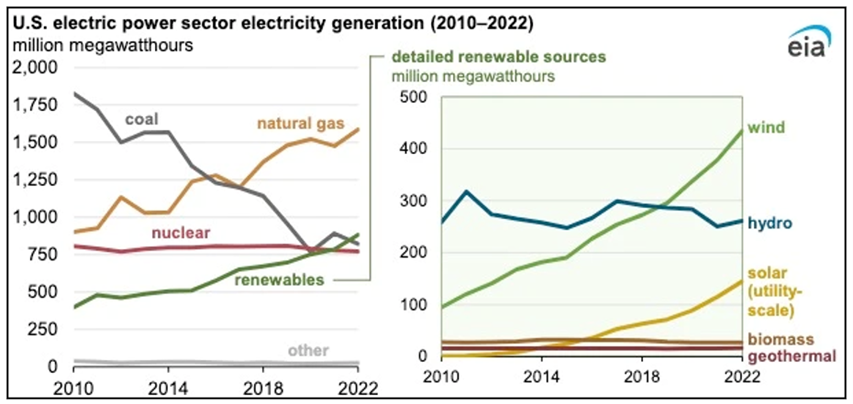

According to the U.S. Energy Information Administration, the amount of renewable power generation — wind, solar, hydro, biomass and geothermal — exceeded nuclear and coal-fired generation in 2022 for the first time ever!

U.S. power stations produced 4,090 million megawatt-hours of power in 2022. Of that, natural gas is the largest source of electricity generation in the U.S. and has grown from 37% in 2021 to 39% in 2022.

The renewable growth came from wind and solar, which increased from 12% in 2021 to 14% in 2022.

Between solar and wind, however, the most growth is in wind. According to the EIA, solar capacity increased from 61 gigawatts in 2021 to 71 GW in 2022, while wind capacity grew from 133 GW in 2021 to 141 GW in 2022.

The EIA forecasts that both wind and solar will grow by 1% in 2023. But as the chart above shows, wind is beating solar by a wide margin. And if you want to add wind power to your portfolio, take a look at FAN or a similar ETF, the Global X Wind Energy ETF (WNDY).

Recommended Action: Buy FAN.