There were three 2-for-1 split announcements since my February newsletter. The recent banking sector turmoil gives us a very good opportunity to add one of them, Greene County Bancorp (GCBC), to the 2 for 1 Index, notes Neil Macneale, editor of the 2-for-1 Stock Split Newsletter.

The three names that split in March are GCBC, Monster Beverages (MNST) and Meridian Corp. (MRBK). MRBK and GCBC are both small banks, but Meridian is just too small to be considered. That leaves me to choose either Monster or Greene County, or neither one.

Monster Beverages has several metrics that are a plus. No long-term debt, fairly profitable, and slightly less volatile than the market. However, MNST stock is very expensive, trading at over 7 times book value and with a PE of 45.

Analysts are predicting higher earnings for the year, thus a lower PE. But I have no faith in those predictions, especially since the Index would be holding MNST for up to three years. MNST is what I would call a "hot" stock and that is not what I'm looking for at this time.

GCBC presents a completely different picture. GCBC has been around since 1889 serving the Catskills in up-state New York. Value measurements for GCBC look good, particularly the price-to-book at less than half of the average of its peers.

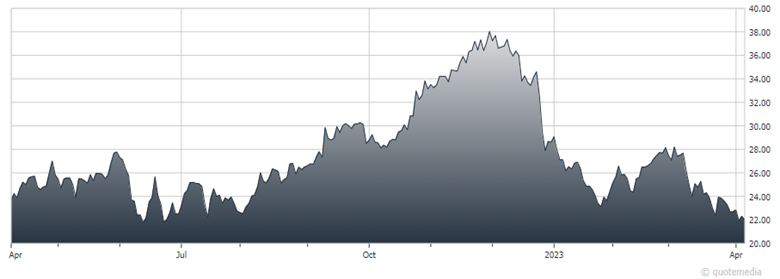

Greene County Bancorp (GCBC)

Earnings growth has been strong over the last several years and most of the increase in revenue has been going to the bottom line. The stock trades with a volatility of only about 20% of the overall market. The dividend yield of about 1.8% has been stable. Six percent of GCBC shares are owned by directors and managers, some of whom have recently been adding to their holdings.

This is a small company and trading is relatively thin. Plus, banks got hammered by the fallout from the Silicon Valley Bank fiasco. But all that being said, that just makes this a good opportunity to add it to the index.

Recommended Action: Buy GCBC.