The Federal Open Market Committee (FOMC) just raised interest rates for the ninth time, pushing the Fed funds target range higher by 25 basis points to 4.75%- 5.00%. But confusion about the Federal Reserve’s future policy steps has left markets in limbo, writes Sam Stovall, chief investment strategist of CFRA Research in the firm’s flagship newsletter, The Outlook.

The FOMC statement suggested that further rate increases might be one or none, since it also showed downward revisions for GDP forecasts in 2023 and 2024 despite strength in macro data since the December FOMC meeting.

Stocks and bonds rallied, because the decision and statement were viewed by Wall Street as dovish, accompanied by the assumption that the FOMC would start cutting rates before the year was out. Yet, during the subsequent press conference, Fed Chair Powell put that notion to rest, indicating that a rate cut this year was not in the cards, and that the Fed was committed to driving inflation back down to 2%.

Finally, despite earlier commitments to insure all depositors at the three failed banks, Treasury Secretary Yellen, in her testimony to Congress on Wednesday, said there would be no blanket deposit insurance. Not surprisingly, Wall Street responded with whipsawed trading.

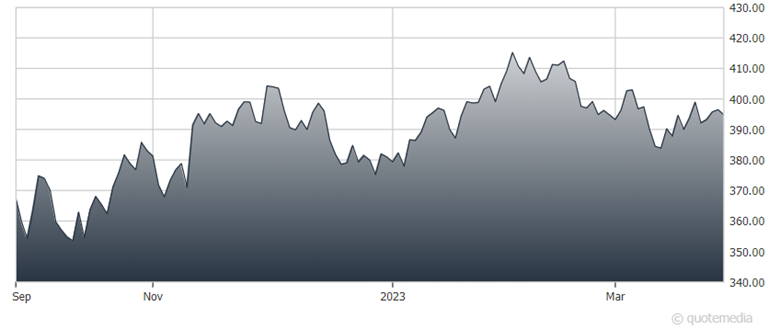

S&P 500 ETF Trust (SPY)

In the week through March 23, the S&P 1500 eked out a 0.8% gain, led by large caps, growth, and the communication services, energy, and information technology sectors. The consumer staples, real estate, and utilities groups were the laggards. Finally, 56% of the S&P 1500’s 149 sub-industries rose in price, while five of the eight deepest decliners were REITs.

Assuming that the economy proceeds as expected, Action Economics forecasts the FOMC to raise rates by 25 bps at both the May and June FOMC meetings, ending its rate tightening cycle between 5.25% and 5.50%, and waiting until Q1 2024 before initiating its first rate cut.