BlackRock Inc. (BLK) is one of the leading investment management companies in the U.S., best known for its expertise in fixed income asset management. The firm had nearly $9 trillion in assets under management as of December 31, 2022, and we think it will continue to gain market share, remarks analyst Catherine Seifert in CFRA Research’s flagship newsletter, The Outlook.

Our Strong Buy recommendation reflects our view that BLK’s top-tier position in passive investments and strong fund performance will attract assets at above industry-average rates over the next few years, despite competitive pressures and secular challenges within the asset management industry. We also see healthy growth potential from equity and fixed income ETFs as well as alternative style funds, which will likely enhance BLK’s asset inflows as new funds gain traction.

Additionally, we are encouraged by the potential of the small but growing Aladdin risk management platform, and see this capability as a factor in widening BlackRock’s competitive moat compared to peers.

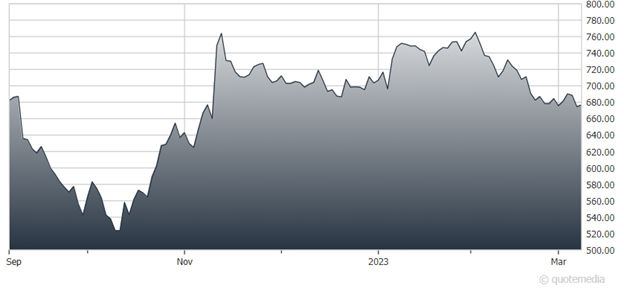

BlackRock (BLK)

We project a 2023 GAAP operating margin of 38%-40%, rising to 40.5% in 2024, versus the 35.7% reported in 2022. Our 12-month target price of $885 is 19.8x our 2024 operating EPS estimate of $44.60 and 21.8x our 2023 operating EPS estimate of $40.55, versus BLK’s three-year average forward multiple of 19.6x, but higher than the peer average of 13x and supported, we think, by BLK’s consistent, above-peer growth metrics and the increased competitive advantage BLK continues to build, aided by its technology division.

Risks to our opinion and target price include depreciating securities markets and adverse regulatory changes.

Recommended Action: Buy BLK