Innovative Industrial Properties (IIPR) is a Real Estate Investment Trust (REIT), which engages in the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated medical-use cannabis facilities. We are bottom fishing here, says Robert Rapier, editor of Income Forecaster.

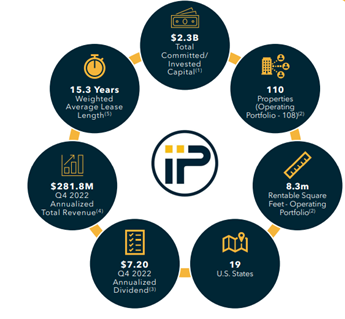

The company operates in Arizona, California, Colorado, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Texas, Virginia and Washington.

The firm’s property portfolio includes PharmaCann, Inc., SH Parent, Inc., Ascend Wellness Holdings, Inc., Cresco Labs Inc., and Kings Garden Inc. The company was founded in 2016 and is headquartered in Park City, Utah.

IIPR recently reported Q4 revenue and earnings that topped Wall Street expectations. Q4 adjusted funds from operations (FFO) per share of $2.12 topped the $1.89 consensus, but was down slightly from $2.13 in Q3. Q4 revenue of $70.5M beat the $69.0M average estimate, compared with $70.9M in the prior quarter and $58.9M in the year-ago quarter.

IIPR recently reported Q4 revenue and earnings that topped Wall Street expectations. Q4 adjusted funds from operations (FFO) per share of $2.12 topped the $1.89 consensus, but was down slightly from $2.13 in Q3. Q4 revenue of $70.5M beat the $69.0M average estimate, compared with $70.9M in the prior quarter and $58.9M in the year-ago quarter.

If you look at the company’s financials, IIPR is growing steadily and rapidly, but the share price is near its 52-week low because of interest rate concerns. We are bottom fishing here, so I want to take advantage of a very large call premium to reduce downside risk.

I typically don’t recommend selling a call against high-yield shares, but in this case I would make an exception. Recently, shares closed at $82.52, but the $90 call on the option expiring on Dec 15 ’23 had a last trade of $9.65. That’s a call yield of 11.7% for a holding period of 291 days.

That is an outstanding call premium which would reduce your net cost to $72.87. If your shares are called away in December, you would be looking at a return of about 28% (including the impact of three dividend payments).

That doesn’t prevent you from taking a loss, but it does give you additional downside protection. Further, if you don’t lose your shares in December, you can turn around and sell another call. The REIT sector isn’t out of the woods yet, but IIPR’s business hasn’t been significantly impacted to this point. The risk to reward balance seems pretty favorable at this point.

Recommended Action: Buy IIPR.