With a high short interest, but also a hefty dividend and stock buyback underway, Medical Properties Trust (MPW) makes an attractive investment, writes Brett Owens, editor of Contrarian Outlook.

MPW is a health care Real Estate Investment Trust (REIT) that benefits from the aging of America! Years ago, easy financing didn’t exist for hospitals. If someone wanted to build, their only option was a traditional corporate loan package. This was a big headache because it forced the hospital to lock up all of its asset value as collateral.

Ed Aldag had the foresight to found MPW in 2002 to tackle this problem. He and his team developed low-cost and flexible alternative financing for hospitals. It worked! Ed’s company is the largest investor in hospital real estate in the U.S. today.

Largest “investor” is crucial: MPW doesn’t run hospitals. It invests in them. The company provides capital to the operators, particularly proven ones. In turn, they use the money to improve facilities, upgrade technology, hire more staff, and expand their complexes (and pay back their loans to MPW).

Yet, holding MPW stock can be quite the rodeo. You wouldn’t expect this from a steady dividend payer (and dividend grower!), but headline news can rattle this stock. The hospital operators—MPW’s borrowers—sometimes have shaky finances.

For example, in 2017, MPW plunged on worries that hospital operator Adeptus Health was in trouble. Investors feared missed or reduced rent payments. Their concerns were valid—Adeptus declared bankruptcy in 2021—but the problems never spilled over into MPW. Adeptus kept paying.

Now, MPW yields a nifty 9.1%. Short sellers not only have to be right to make money, but meanwhile they are on the hook for this dividend. Imagine having to pay 9.1% per year to keep a short position. Ouch!

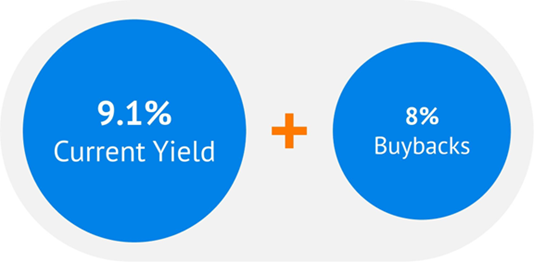

But wait, it gets worse for them. MPW really boasts an annual “hidden yield” of 17.1% when we consider buybacks, which are in effect non-taxable dividends. Seventeen-point-one percent. Per. Year.

A Hidden Yield Formula for 17.1% Yearly Returns

With over 17% of MPW’s shares being sold short, there is fuel for a potential rally because these positions must be bought back later. Plus, we may be past an important inflection point. MPW’s Board of Directors recently announced a $500 million repurchase authorization. This gives Ed and his team the OK to buy back a whopping 8% of the company’s outstanding float in the next 12 months.

Plus, I think MPW will be able to help its operators muddle through their current issues without much concern for the bottom line. Which means the shorts are about to get squeezed. Very. Tightly.

Recommended Action: Buy MPW up to $15.