From an investment standpoint, there is no question that EVs are the future of the automobile industry. That is music to the ears of EV makers, especially U.S. EV maker Tesla (TSLA), exclaims Tony Sagami, editor of Weiss Ratings Daily.

When it comes to powering cars, our options are either extracting oil from the earth to power an internal combustion engine or extracting massive amounts of minerals needed to make batteries for an electric vehicle.

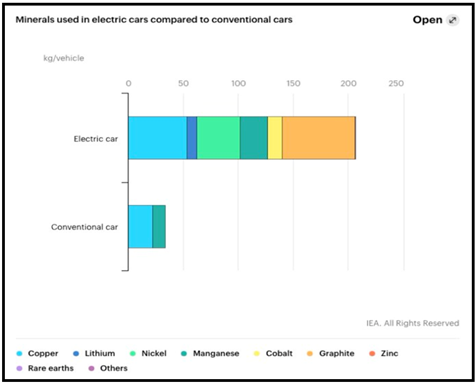

It’s an inconvenient truth, but an EV requires 600% more minerals than a conventional car. Those minerals aren’t light. A typical EV battery weighs 1,000 pounds. That battery includes 190 pounds of graphite, 130 pounds of nickel, 90 pounds of copper, 60 pounds of cobalt and 30 pounds of lithium.

In total, every 1,000-pound EV battery requires moving over 500,000 pounds of earth, creating mountains of rubble from the mining and processing of minerals.

Meanwhile, EVs have zero tailpipe emissions. But the energy used to charge the batteries is only as clean as the power plant that produces the electricity. According to the U.S. Energy Information Agency, 65% of America’s electricity is produced from fossil fuels: 38% from natural gas, 22% from coal and 5% from petroleum.

That said, there’s no going back. We’re gradually shifting to EVs – and Tesla recently dethroned BMW as the luxury sales king after the German brand held the title for the past three years. It is also the first time in 25 years that an American brand has led luxury sales.

Tesla didn’t just beat BMW, it beat the pants off them. According to Automotive News, Tesla sold 491,000 EVs in 2022, which was 158,612 more than BMW. That 491,000 vehicles sold by Tesla was a whopping 44% increase in sales from 2021.

Tesla’s stock has been under pressure ever since Elon Musk bought Twitter, but I consider that a temporary speed bump. Tesla reports its next quarterly results on April 18, and I expect it to smash Wall Street’s 85-cents-per-share profit forecast.

Recommended Action: Buy TLSA.