BHP Group (BHP) is an Australian metals and mining company with a shiny nickel future. Its shares recently pushed up through overhead resistance, and The Force Index, my favorite momentum indicator, is bullish, highlights analyst Sean Brodrick, editor of Wealth Megatrends.

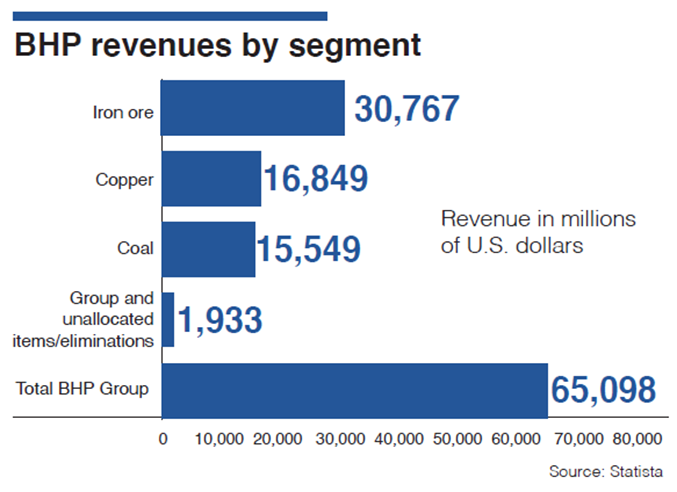

This mining giant is the largest in the world by market capitalization, with a recent market cap of $162 billion. It explores, produces and processes iron ore, metallurgical coal and copper. Last year, it generated approximately 47% of its revenue from iron ore, 26% from copper and 24% from coal.

While the company also produces nickel, gold, silver, zinc, molybdenum and uranium, those don’t matter much in the big picture. However, BHP has its eye on the green energy transition and is taking steps to boost nickel output.

The company already has a nickel supply agreement with Tesla (TSLA). According to BHP, the average lithium-ion battery contains 40 kilograms (88 pounds) of nickel, and the demand for nickel will increase 4x in the next 30 years due to the rise of the EV industry.

And while there is enough lithium and nickel to power 14 million EV batteries in 2023, the number is expected to reach 21 million globally by 2025. From 2021–2030, the global EV market is expected to show a compound annual growth rate of 18.2% and reach $823.7 billion by 2030.

The thing is, nickel’s already popular, too. It’s used in many industries, from aerospace to defense, and 66% of nickel is used to produce stainless steel. In 2022, BHP produced some 76,800 metric tons of nickel — lower than the previous year, and in fact, BHP’s nickel production peaked in 2010.

To boost its nickel production, BHP is doing a couple things. First, it’s significantly expanding its processing plant at the Mt. Keith nickel mine in Australia, which should raise production at Mt. Keith by 40%. Second, BHP signed a $6.5 billion binding offer to buy Australian copper-gold miner OZ Minerals (OZMLF), which would be its biggest acquisition in over a decade.

Meanwhile, BHP reports financials and pays a biannual dividend. In September, the company raised its dividend 3% to $3.49 per share. That works out a yield of 9.6%. But BHP pays a dividend that fluctuates with earnings — BHP’s dividend policy provides for a minimum 50% payout of underlying attributable profit every reporting period — and last year’s earnings jumped due to the sale of BHP’s petroleum assets.

My intermediate target is $86 a share. Longer term, my target is $107 a share.

Recommended Action: Buy BHP at the market.