In the early 1900s, Charles Henry Robinson owned a wholesale brokerage house that provided produce in North Dakota and Minnesota. It grew from there, and now C.H. Robinson Worldwide (CHRW) provides freight transportation, management, brokerage, and warehousing worldwide, explains Jimmy Mengel, editor of The Profit Sector.

CHRW currently has 100,000 customers, $28 billion under freight management, and delivers 20 million shipments per year. They also have Robinson Fresh, a brand that buys, sells, and markets fresh produce and products.

CHRW has continued to automate its business and now boasts 658,000 fully automated bookings with carriers in their truckload business, which is an 87% increase compared to Q3 of 2021. Loads booked digitally by carriers increased 144% from January to September 2022, marking a 173% increase year-over-year.

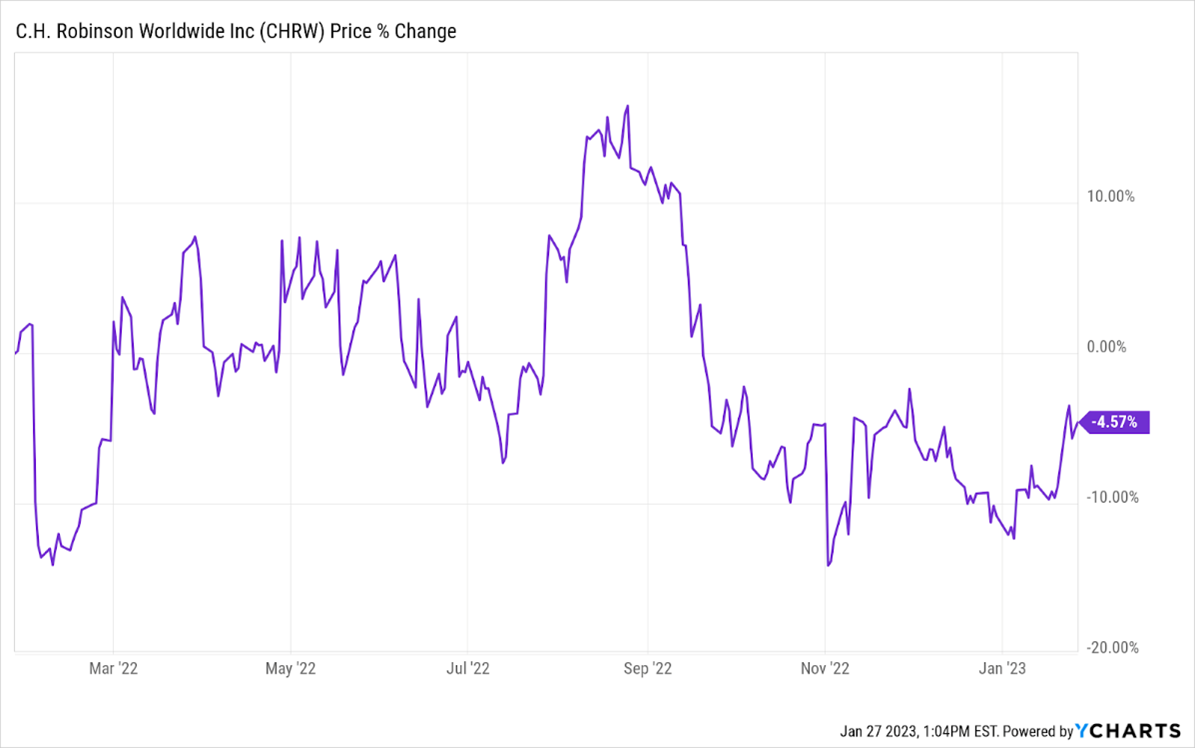

They get $1.2 billion of revenue through this growing digital channel. And while the stock hasn’t generated tremendous returns over the past year, it has certainly kept pace with the broader market:

CHRW also delivers reliable increases to its dividend each and every year, which is why the stock was crowned as a dividend aristocrat for the first time this year. It currently yields 2.5%.

However, as you can see in the chart above, the stock dropped significantly after UBS cut its rating to Sell from Neutral. UBS analyst Thomas Wadewitz wrote that he sees a sharper drop in revenue and earnings per share due to “dramatically lower ocean shipping rates and a drop in truckload contract rates.”

The company has already started cost-cutting measures to combat those trends, the most recent of which was the layoff of 650 employees in November. If there is any silver lining in mass layoffs, some sources had estimated somewhere in the realm of 1,000 to 1,200 employees getting the boot.

CHRW recently traded around $98, representing a significant drop. Long-term, C.H. Robinson should be able to right the ship, but I’d wait until a dip closer to $80 before wading into those waters.