Will 2023 be the year that gold hits $3,000 an ounce? asks Frank Holmes; here, the CEO of US Global Investors and editor of Investor Alert, offers a long-term bullish case for the precious metal.

Ole Hansen, respected commodity strategist at Denmark’s Saxo Bank, says it’s possible once markets realize that global inflation will remain hot despite monetary tightening. I believe, as I’ve said before, that gold could climb as high as $4,000.

Hansen notes three other factors that could help push the metal to new record highs next year. One, an increasing “war economy mentality” could discourage central banks from holding foreign exchange reserves in the name of self-reliance, which would favor gold.

Two, governments will continue to drive up deficit spending on ambitious projects such as the energy transition. And three, a potential global recession in 2023 would prompt central banks to open the liquidity spouts.

The analyst has already said that his comments are less of a forecast and more of a thought experiment, but I don’t think investors should brush him aside so easily. I believe it’s very possible that we could see $3,000 gold—or higher—in the next 12 to 18 months, for all the reasons he mentioned.

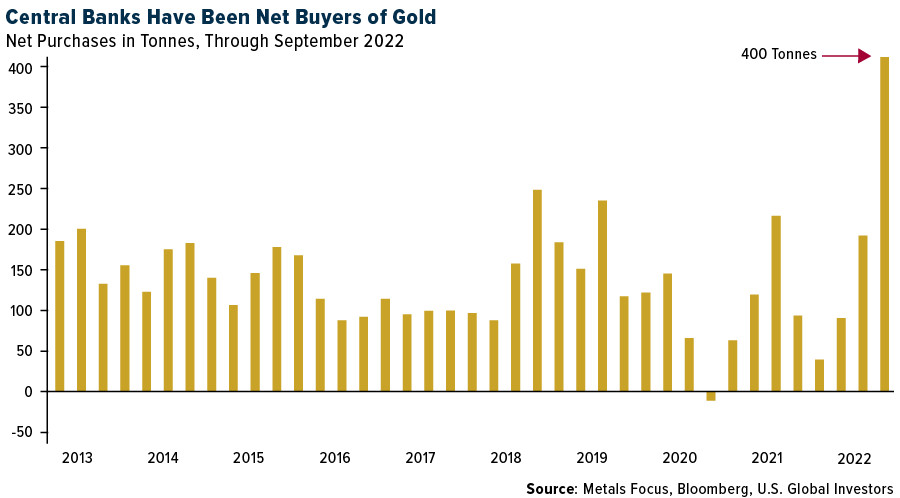

Central banks are on a gold buying spree. Hansen is correct in bringing up central banks’ increasing appetite for gold as a reserve asset. Central bankers and finance ministers may be all about fiat currency, but behind the scenes, they’re gobbling up the yellow metal at the fastest rates in living memory. In the third quarter, official net gold purchases were approximately 400 tonnes, around $20 billion, the most in over a half-century.

Turkey was the biggest gold buyer in the third quarter, followed by Uzbekistan and India. This past week, China’s central bank disclosed it purchased gold for the first time since 2019. The Asian country said it recently added 32 tonnes, or $1.8 billion, bringing its total to 1,980 tonnes.

Despite being the sixth largest holder of gold, not counting the International Monetary Fund (IMF), China still has a long way to go if it wants to diversify away from the U.S. dollar in a meaningful way. The metal represents only 3.2% of its total reserves, according to World Gold Council (WGC) data.

Compare that to 65.9% of reserves in the U.S., the world’s largest holder with more than 8,133 tonnes. This is very bullish, and I predict we’ll be seeing a lot more buying from China in the coming months.

With inflation looking to persist into next year, a small to moderate recession appears more and more likely. There’s the risk that the Federal Reserve will overtighten, and this has strong macroeconomic implications for gold.

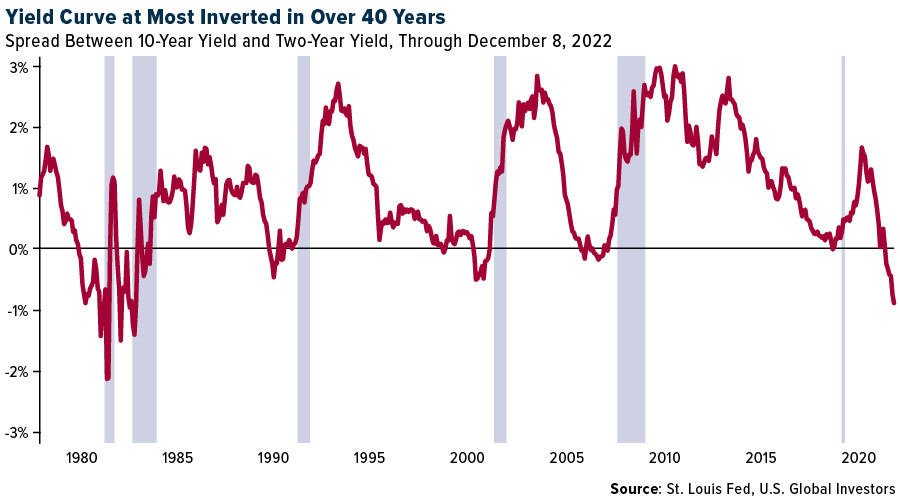

An indicator we keep our eyes on is the spread between the 10-year Treasury yield and two-year Treasury yield. Over the past 40 years (at least), every recession has been preceded by a yield curve inversion. As of today, the yield curve is at its most inverted in over 40 years, suggesting a recession is all but guaranteed. The question is not if, but when.

In recent days, most banks and ratings agencies have slashed their global growth estimates for 2023 on expectations of persistently high consumer prices and rapid monetary tightening. Buying gold now could prove itself to be a wise investment choice. In five out of the last seven recessions, gold delivered positive returns, according to the WGC, providing some protection to investors.

Is gold setting up for a rally? Technically, gold is starting to look attractive right now, the metal having broken above its 50-day and 200-day moving averages. After breaching the key $1,800-an-ounce level last week, gold is again testing the psychologically important price point.

If 2022 ended today, this would mark the second straight year that gold has declined. And yet, at negative 1.75%, the yellow metal has remained one of the best assets to hold this year.

It hasn’t always been easy. Holdings in all known gold-backed gold ETFs have declined for seven months straight as of November 2022. However, we’re starting to see these declines level off as gold begins to push higher.

A gold rally — possibly to $3,000, as Ole Hansen forecasts — would also be highly constructive for gold mining stocks. These companies are much more volatile than the price of the underlying metal. As you can see above, when gold has jumped, gold mining stocks have historically jumped higher. (The reverse has also been true.)