China’s President Xi Jinping recently increased his grip on the government and the country when he was named to another term as head of the ruling Communist Party, explains Bryan Perry, a leading growth and income expert and editor of Cash Machine.

He immediately eliminated layers of the upper echelon of the government and promoted allies who support his vision for tighter control over society and the economy.

This is a major shift in China's policy, as Xi looks to quell much of the gains made in the market-oriented reformist ideology that has fueled the enormous presence of Western corporations in China. Xi then called for faster military development, self-reliance in technology and the defense of China's interests abroad by whatever means, raising the specter of further economic tension.

The party has a new directive to tighten control and roll back the market reforms that will surely weigh on both domestic and foreign companies doing business there. This new paradigm creates a major opportunity for companies looking to relocate their manufacturing process, and that opportunity, in my view, exists in India.

India provides the tech savvy culture and labor force for companies like Apple Inc. (AAPL) to move their production out of China and not miss a beat. In fact, Apple is already undergoing this shift, having shipped over $1 billion in iPhones this year from India.

For our purposes, The India Fund (IFN) is the go-to closed-end fund that fits the profile for how I want us to play this monumental shift in global manufacturing. With a market cap of $500 million, IFN is liquid and trades at an attractive 11.6% discount to its net asset value of $18 per share.

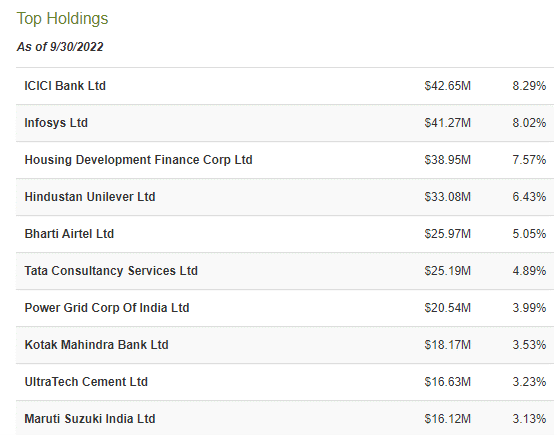

At its current share price of $16, the shares pay a current annual yield of 11.55%. The dividends are paid on a quarterly basis. The portfolio owns 39 holdings, has an average annual turnover of only 22% and employs no leverage.

The mix of the top 10 holdings is very well positioned to benefit from the new influx of global companies that are seeking a new home away from China and a place where there is ample capacity to execute economies of scale.

The Indian economy is an emerging market juggernaut, expanding by 13.5% year-on-year in the second quarter of 2022. But fears of a global recession have pressured the Indian market and the Indian rupee lower. Shares of IFN have traded as high as $23.35 in the past year and therefore are down by roughly 31%.

Let’s add this deeply discounted, high-yield asset to our Extreme Income Portfolio, since dividends are paid out of long-term capital gains. I believe that this is a secular trend in the making, and our early timing in buying into this trend while the market is trading at depressed levels will reward us well by this time next year.