Electric vehicle sales are soaring, driving demand forecasts higher and higher for the metals in the batteries and wiring, explains Sean Brodrick, an expert in the natural resources sector and the editor of Wealth Wave.

Supply will be hard-pressed to keep up. And if you act now, you could set yourself up for a potential mountain of profits.According to data from EV Volumes, a total of 4.3 million new battery EVs and plug-in hybrid EVs were delivered during the first half of 2022. That’s an increase of 62% compared to the first half of last year.

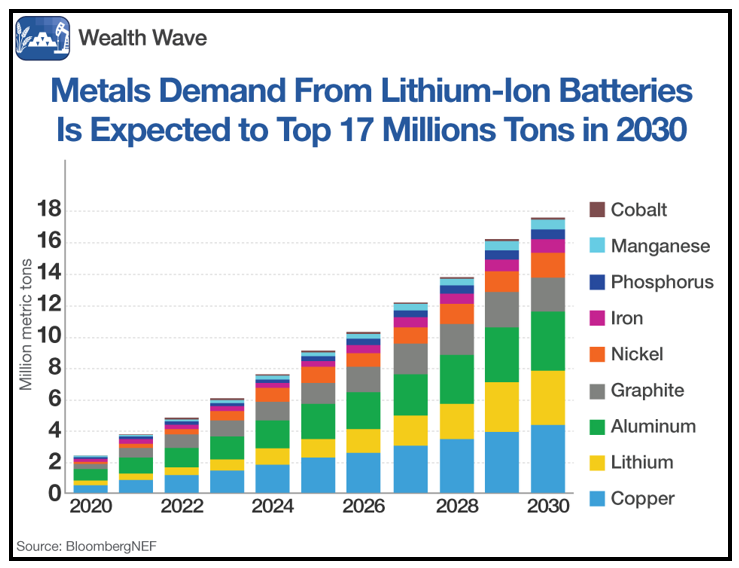

EV demand is the main driver of battery metals. The other is electricity storage, which is necessary for alternative fuels. Let’s see what this will do to demand for battery metals:

As you can see, overall demand for metals used in lithium-ion batteries is forecast to eclipse 17 million tons by 2030. That’s according to Bloomberg New Energy Finance.

Here’s the wild part: As recently as a year ago that forecast was for a rise of just 10 million tons over the same time frame. So, in the past year, the forecast for battery metals demand has soared by 70%!

Throw in stricter and stricter sanctions on Russian exports of aluminum, nickel, copper and other metals, and prices could become quite volatile.

Are those mines going to be built? Maybe. We’ll have to find the deposits first. There is now less hard-rock lithium being produced by mines than in 2019 because the economic crisis that came with the pandemic tipped some miners into bankruptcy.

So, what if America — and the world — tips into recession? That would weigh on demand for some of these metals, but not all, or at least not a lot. Lithium and nickel in particular look to have very strong fundamentals. And global inventories of copper at exchange warehouses are near the lowest level in more than a decade.

How can investors play this wealth wave? There are exchange-traded notes that let you track and trade the metals. But my choice would be miners that are leveraged to the underlying metal and that also pay fat and growing dividends. This is because even if the blast-off in metals prices is delayed, you’re paid to wait.

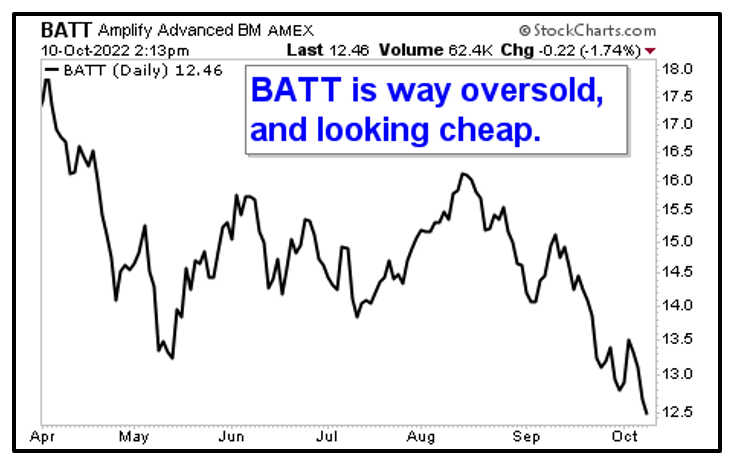

And since these miners have been dragged down with the broad market, you can buy them at huge discounts. You could roll up your sleeves and do the hard work to find individual miners. Or, you can just buy the Amplify Lithium & Battery Technology ETF (BATT).

It’s loaded with great metals miners including BHP Group (BHP), Glencore (GLNCY), Albemarle (ALB) and more. And it sports a forward dividend yield of 2.8%. That compares nicely to the S&P 500’s forward dividend yield of just 1.8%. One more thing — and you may not like this — BATT is trading near a 52-week low:

I don’t see this as a problem. For one thing, many of the stocks in BATT are way oversold and looking dirt-cheap at recent prices. Also, I know there’s a massive megatrend in place that is going to push demand for these metals higher — and the stocks of companies that mine them will go along for the ride.

You might not be buying at rock-bottom, but that fat dividend pays you to be wrong for a bit until the hit that point. The long-term forecast is much higher. So, you’re buying BATT out of the bargain bin.

You can play the battery metals megatrend however you like. But don’t ignore this opportunity. As always, remember to conduct your own due diligence beforehand.