Shares of Boeing Co. (BA) have begun a long-awaited recovery in the form of new plane orders for the 737 MAX that is now at a production run rate of 31 planes per month since coming back online, notes Bryan Perry, editor of the recently launched speciality options and trading service, Breakout Options.

That new momentum in deliveries helped the company to record a return to generated positive free cash flow per today’s release of second-quarter results.

A breakdown of Q2 revenues by segment follows: Commercial Airplanes +3% year/year (Y/Y) to $6.22 billion, driven by higher 737 deliveries, partially offset by lower 787 deliveries; Defense, Space & Security -10% to $6.19 billion; Global Services +6% to $4.3B.

The second half of 2022 should see sales and earnings momentum increase as the company pursues the expansion of increasing monthly output. With the return of the 737 MAX, 2022 revenues are expected to climb by 19% to $74 billion, with the company looking to break even this year and earn between $5-7 per share next year.

This is a blue-chip turnaround story in the making and will be fueled by headlines of further plane orders. At this year’s Farnborough Airshow, the global stage for commercial airline makers to promote new aircraft and announce new orders, Boeing and Delta Airlines announced an order for 100 Boeing 737 MAX-10 jets with options for 30 more.

Additionally, the companies agreed on an order for Boeing Global Services to reconfigure the cabins of 29 Boeing 737-900 ERs. Also, it was announced that Delta will become a service provider for the CFM LEAP 1B turbofans used on the Boeing 737 MAX.

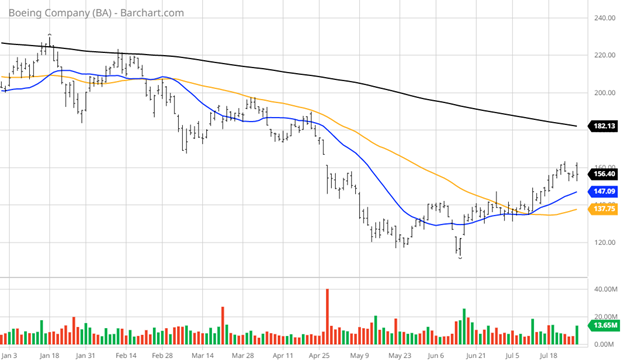

As for the stock, shares of BA are in a new uptrend, hitting $162 in reaction to the latest earnings report. The shares settled back to $156, with no real upside technical resistance until around $180, depending on news flow.

As long as the company can keep bringing in new business, the stock has strong potential for further gains ahead. The stock traded at $450 in early 2019. So, there a lot of upside if the company can stay on track with its recovery.

Buy the BA Jan. 20, 2023, $180 Calls at market. The calls are currently quoted at $10.12 per contract.