We are officially in a bear market, with the averages down over 20%. So, what does that mean going forward? asks Jack Forehand, an investment strategist and editor of Validea.

I certainly don’t know and it is likely that most experts who try to predict the future don’t either. But there are some key lessons I think all of us can keep in mind during bear markets.

Here are five lessons I think investors should remember during times like this.

1) Stocks Are the Best Long-Term Investment

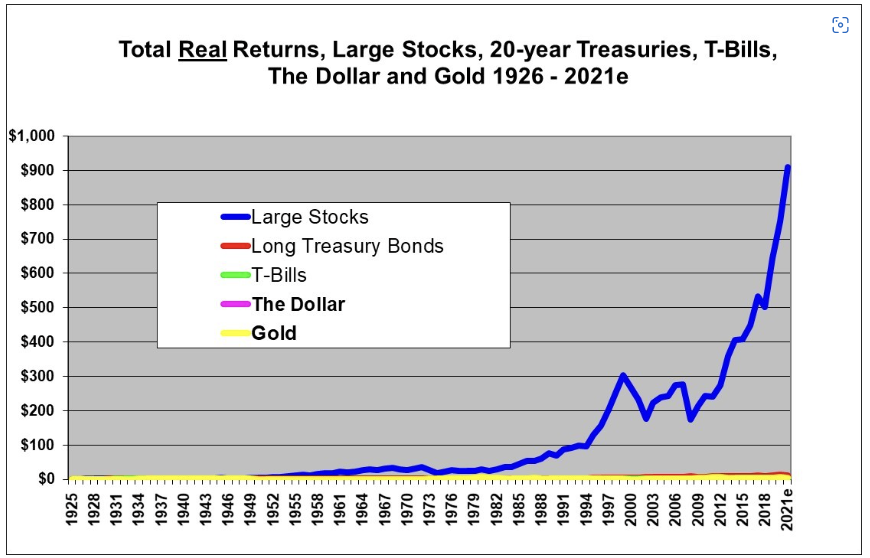

There is no asset class that outperforms stocks over the long run. They outperform bonds. They outperform commodities. They outperform cash.

And for all the Bitcoin supporters out there, there is no currency nor other store of value that beats stocks. Stocks have trounced gold over the long run. There is nothing you can invest in that has more evidence to support its long-term performance than stocks.

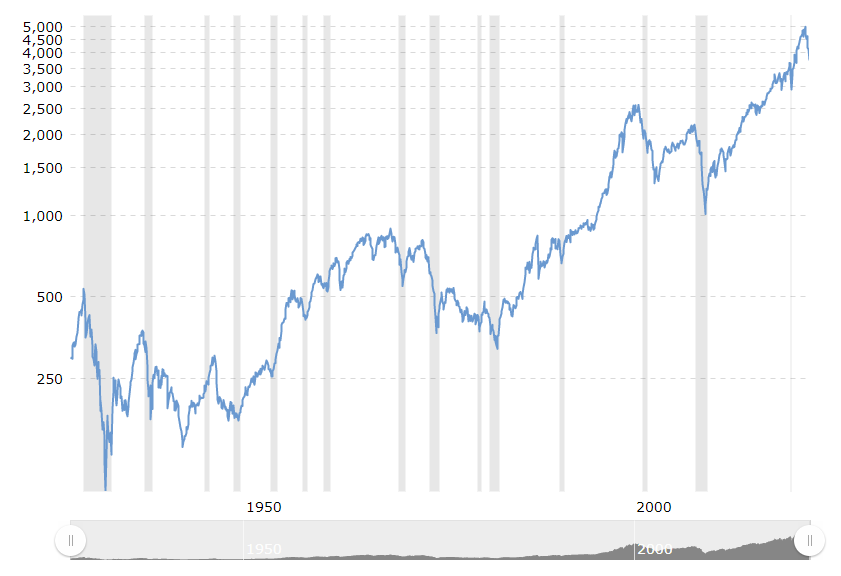

Take a look at the chart below of the long-term performance of stocks and then look at the recent decline. The small blip all the way to the right that represents it is inconsequential relative to the rest of the chart. The same thing will be true whether we get a 25%, 30% or 40% decline here. Even 2008 looks minor relative to the long-term returns.

But with performance comes risk. The path to long-term outperformance in stocks includes sitting through substantial pain. That pain is the price you pay for the long-term results you get.

2) Time is Your Friend

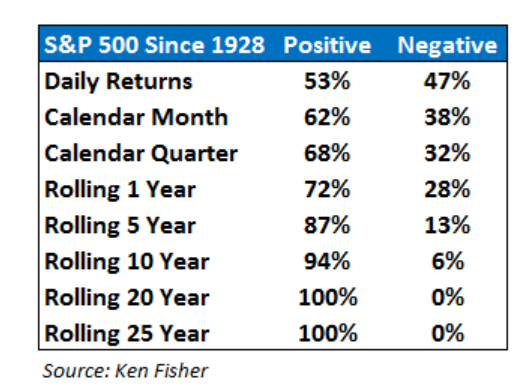

In times like this, it is important to widen your view. On a daily basis, stock returns are close to a toss-up. Over a year, the odds are about 70% in your favor. Over 20 years, the odds are overwhelmingly good.

Nothing is certain in investing so we can’t take these historical statistics and imply the future will look the same as the past. For example, investors in Japan will beg to differ with the idea from this chart that positive 20-year returns have a 100% probability. But either way, the longer your horizon, the greater your odds. This is important to keep in mind at times like this.

3) Beware Bear Market Analogues

Just in the past week, I have seen the current bear market compared to four different markets in history. Some compare it to the 1970s due to high inflation. Others compare it to 2000 because that bear market was driven by technology overvaluation. Still others compare it to 2008 because they see a more significant crisis coming.

And finally, the biggest doom and gloomers see a repeat of the Great Depression. But the reality is that every bear market follows its own path. Each has its own facts and circumstances. And expecting history to follow any exact pattern can be dangerous. History often rhymes, but it rarely repeats itself exactly.

4) It is Darkest Before the Dawn

We would all love to get the obvious all clear signal that a bear market is over. It would be great for the market and economy to tell us when it is time to aggressively invest in risk assets. But if history is any guide, the bottom will be the opposite of that. It is likely the economy will be a mess.

It is likely many forecasters will be telling us it is going to get much worse. It is likely many will be questioning whether stocks are worth investing in anymore. At the 2008 bottom, things were still looking very ugly. In 2020, there was a worldwide pandemic with no end in sight. If you are waiting for the green light that it is safe to invest, you aren’t likely to get it.

5) Conviction in Your Investment Approach is Essential

The most important thing about investing is often not what you invest in, but how much you believe in it. The reason is that conviction is what allows you to stick with your plan when times get bad. If you begin to question your investment approach during periods of market decline and volatility, then you won’t stick with it. If you don’t stick with it, you won’t achieve your goals.

If you setup an investment plan that makes sense given your goals and risk tolerance, and you believe in it, then you will resist the temptation to question it when things are bad. In fact, you will likely use those periods as opportunities to add to your investment positions because you will see the struggles as a buying opportunity.

This doesn’t mean your approach has to be long equities. In our latest podcast episode, we talked to Wes Gray of Alpha Architect, whose investment approach relies on trend following and managed futures and looks nothing like most investors’ portfolios. But Wes has conviction in it, which will allow him to stick with it when it isn’t working. That is the key to making it work.

In the end, no one knows where we go from here. The Fed may engineer a soft landing. They may not. The 40 years of elevated returns from the 60-40 portfolio may be over. Or people like me who have suggested that to be true might be years early in that call.

The key to being a long-term investor is remembering what “long-term” truly means. Investors who can do that are much more likely to have the proper context during times like this. They are also much more likely to achieve their investing goals.