Halozyme (HALO) has been the top stock on our watch list for a few weeks now, and while it’s not immune to the market’s wiggles, the stock has actually been rounding out a big launching pad as the indexes implode, observes Mike Cintolo, editor of Cabot Growth Investor.

And, really, why shouldn’t it? While economic fears abound and interest rates spike, none of that should affect the firm’s enticing growth story: Halozyme’s Enhanze drug delivery technology uses a proprietary method to break down cellular barriers to bulk fluid flow in the skin, which means many leading treatments can be given via IV in just a few minutes instead of a few hours.

Halozyme gets milestone payments as licensees move Enhanze versions of existing drugs through the approval process, but the real money is in ongoing royalties — right now, two drugs — one by Johnson & Johnson (JNJ) and one by Genentech — are driving royalties higher (the firm sees royalties rising 50% this year and making up 55% of revenues), and those two have further upside down the road.

But just as exciting are a handful of new Enhanze-related launches that are likely to be approved starting next year, the first of which is an autoimmune treatment by Argenx (ARGX) that many analysts think could have north of $2 billion of revenue by 2026.

All in all, Halozyme has a longer-term goal for royalty revenue to reach $1 billion by 2027 as these new treatments hit the market. And then there’s the company’s purchase of Antares Pharma, which brings Halozyme a royalty-based auto-injector platform that will be immediately accretive to results.

For 2022, earnings as a whole for HALO are expected to rise just 5%, but that’s solely because it’s starting to pay taxes; revenues should rise 33%, and next year, both sales and earnings are likely to grow at 30%-plus rates, with plenty of expansion beyond that. (We’re not huge on valuations, but the trailing P/E of 21 certainly seems reasonable.)

If you’re looking for something to worry about, some Enhanze patents could expire within two (in Europe) to five (in the U.S.) years, though management is downplaying that, saying so-called co-formulation patents and its other intellectual property, not to mention its clients’ comfort in getting the proven product from Halozyme rather than a fly-by-night operation, make it very confident in future royalty streams.

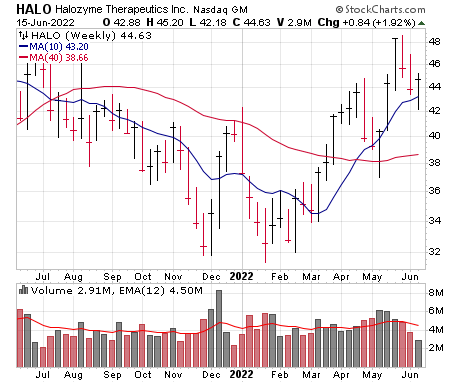

Clearly, big investors agree, as HALO continues to act well, with even the recent dip finding support near the 50-day line. We could consider a half-sized stake if the market can firm up a bit, but whether you nibble or not, the stock is in pole position to do well if/when the bulls return.