This is as pivotal a moment as I've seen in my 52 years of stock market observation, cautions Alan Newman, market timing specialist and editor of CrossCurrents.

We have two scenarios to turn to and we apologize for our inability to just hang our hat on one of them. But let's examine them anyway.

We have said for quite awhile that Dow 29,856 was "major support" and we expected "a break below our major support level to lead to a immediate cascade down another 3000 to 4000 Dow points."

That's a pretty heavy forecast. But we're not quite sure about Friday's penetration. Last Friday's print low was Dow 29,653, a mere 0.7% below support but the Dow closed at 29,888, 23 points above. Clearly, we were right on this area of support but we believe we need more activity to confirm if this was a significant break and a further validation of our expectation for additional immediate damage.

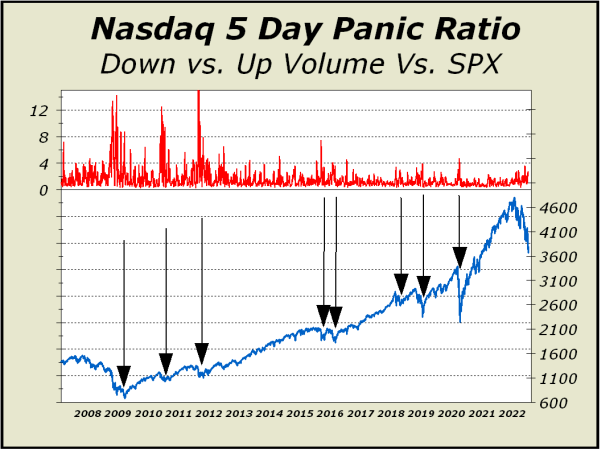

In favor of the bearish scenario, we still have not yet experienced a single climax. We define a climax as a 1:9 up volume to down volume session for Nasdaq since May 12, 2020 and that single occurrence since May 16, 2017 was the only climax in the last 1275 sessions. Our data back to 1998 would suggest normalcy would have resulted in 37 climaxes in the past five years, not just one!

The first chart is also bearish. Panic does not yet seem to be the order of the day. Past reversals, be they short or longer term, came on considerably larger spikes in panic.

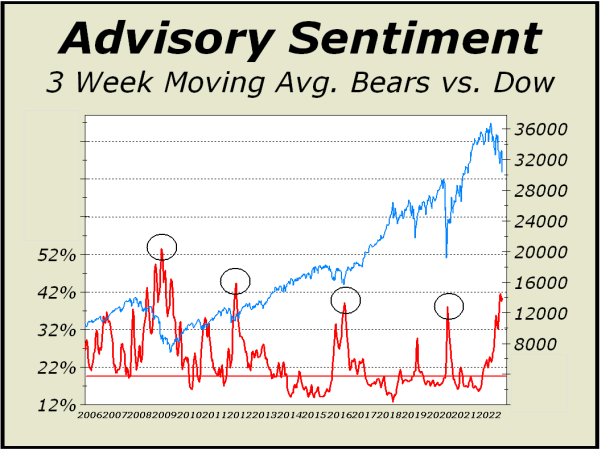

The offset is sentiment, which has turned quite ugly as you see in our second chart.

This swift move towards pessimism would typically be sufficient to temper the bear view at least temporarily. As well, we have seen quite normal climax activity for volume reported on the New York stock exchange, but this is just a small blessing for bulls as Nasdaq volume stats are typically more than 75% of total volume.

Given the tremendous and horrific declines in the tech heavy index the almost complete absence of panic is astonishing. There is simply no point in arguing the case for a bounce or even consolidation. Whatever we might show in favor of the bulls pales by the evidence pointing to much lower prices further out.

We have railed against crypto for months. The recent collapse has taken crypto assets down two-third from their peak — less fuel to feed any bullish tendencies. Our most salient point is our major support level of Dow 29,865. We are there.