CVS Health Corporation (CVS) is one of the nation’s leading healthcare companies, with almost 10,000 stores, notes Carl Delfeld, editor of Cabot Explorer.

To begin, healthcare is recession-resistant. It doesn’t matter whether the economy is expanding or contracting, whether inflation is high or low, or whether interest rates are rising or falling. People who need medical attention will get it one way or another. The demand for medical services is largely steady. Nearly 70% of Americans live within three miles of a CVS and it has more than 102 million pharmacy plan members.

CVS serves more than 38 million people with health insurance provided by government or private plans, including those offered by Aetna, which CVS bought in 2018. In addition, CVS operates more than 1,100 walk-in clinics in its stores, which are visited by more than 50 million patients — with expanded healthcare offerings, including in-house blood work.

CVS’s digital operations allow its customers to refill prescriptions through an app and pick them up at any store location. Or it delivers medications directly to patients’ homes with an electronic prescription from their doctor. Interestingly, online customers spend 2.5 times more than retail customers, and manage 1.5 times more prescriptions. And they remain loyal customers.

CVS is also a technology leader using blockchain, cloud migration and intelligent automation to improve operations and results. The company has also administered 29 million COVID-19 tests and 30 million vaccines.

The proof is in the pudding: The previous quarterly results were exceptional. Total revenues grew 11% to $73 billion and earnings of $2.42 a share were 17% ahead of consensus estimates. (CVS reports earnings for the March quarter on May 4th.)

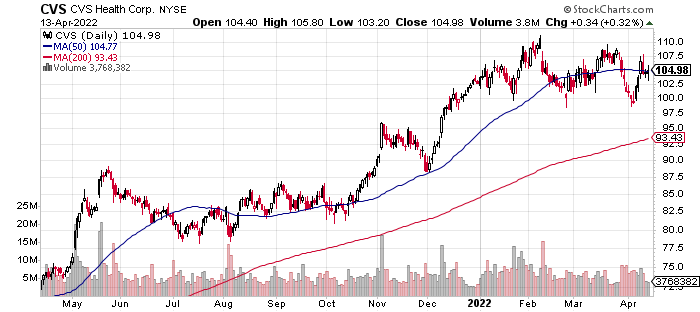

The company also paid down close to $8 billion of debt and paid out $650 million to shareholders through dividends. But CVS stock sells for about 15 times forward earnings — versus 25 times for the S&P 500 — with a dividend yield of 2.1%.