We’re all living in an inflation tornado, and one of the gems that will be left behind after it makes its nasty spiral out is shiny gold profits, notes Tony Sagami, editor Weiss Ultimate Portfolio.

The last time inflation was this high was in the 1970s and the price of gold jumped by more than 300%! Gold is already having a good year — up 7% so far — which is not quite a 1970s-type return, but it tells me that there’s lots of room for gold to move higher.

First, the inflation numbers keep getting worse and are headed higher. I say that because the Federal Reserve doesn’t have the guts to raise interest rates high enough to cool inflation.

Retail investors, like you and I, understand that better than the pinstripe crowd on Wall Street. That is why regular folks have been buying gold bullion and coins like crazy.

The U.S. Mint just reported its second highest Q1 sales of gold American Eagle coins ever … second only to 1999. It’s a smart move to make. I think everyone should have a stash of gold and silver bullion/coins in their possession for emergencies.

While physical gold is red hot, paper gold has lagged. That disconnect won’t last long. Mining stocks tend to magnify the price action in the gold market and outperform the gold price to the upside.

And all this bullishness for the precious metal is a perfect segue to an update on U.S. Global GO GOLD and Precious Metals Miners ETF (GOAU) — a position in our model portfolio.

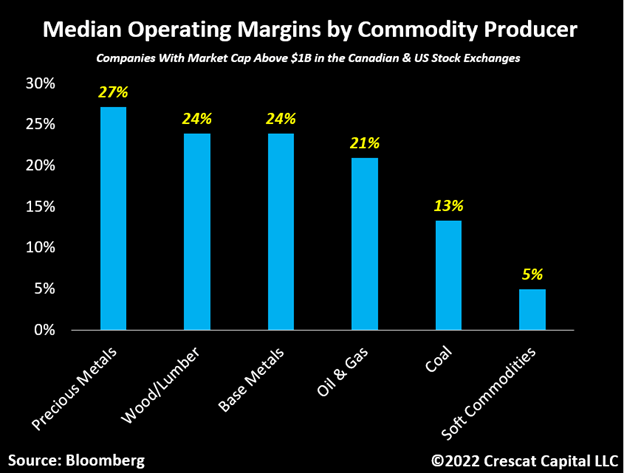

There has never been a better time to be a gold miner. The profit margin for gold minters is at an all-time high at 27% and GOAU’s top holdings are minting money:

Franco-Nevada (FNV) and Wheaton Precious Metals (WPM) — the No. 1 and No. 3 holdings of GOAU — are sitting on a mountain of cash: $569 million and $226 million, respectively.

Newmont Mining (NEM) is not a GOAU holding, but the fact that it increased its dividend by 50% in 2021 and is now one of the top 10% yielding stocks in the S&P 500 tells me how profitable the gold mining business is at current gold prices. Franco Nevada, by the way, upped its dividend by 6.7%.

Gold companies are generating so much free cash flow and mining insiders are so confident of the future that several miners — Newmont Mining, Barrick Gold (GOLD) and Agnico Eagle Mines (AEM) — have announced huge stock buyback programs.

Despite the combination of record profit margins and exploding free cash flow, mining stocks are selling at ridiculously low valuations to the current price of gold. Our GOAU position has been hovering around the breakeven mark … but that should change very soon when gold prices explode.