“It’s a new car!” That’s what the game show hosts of yesteryear used to say when presenting the big “showcase” prize to contestants who could win a new vehicle, asserts Mark Skousen, editor of Fast Money Alert — and a participant in The MoneyShow Las Vegas on May 9-11.

Today, the allure of winning a new car seems to be a bit of a banality by comparison. Now, that’s not because new cars aren’t desirable. They definitely are, but in past years, the idea of buying a new or used car came with so much hassle and haggling with the dealership that being awarded a new one and avoiding the frustration was a virtual godsend.

These days, however, buying cars is really, really easy. So easy, in fact, that you can do it ensconced in your favorite armchair while still in your pajamas. One such company making that possible also happens to be our latest new portfolio addition, and it is CarGurus Inc. (CARG).

CarGurus Inc. acts as an online automotive marketplace to connect buyers and sellers of new and used cars. The company provides three types of marketplaces: listing products, restricted listings and enhanced or featured listing through which it offers real-time and historical data analyzing the connections and pricing analysis.

The company also provides all dealers with a web widget to place so-called “Deal Rating Badges,” which show how good a value the customer might be getting on a potential purchase.

From a recent experience, we know CarGurus is very helpful in the process because the pre-owned Jeep Wrangler Rubicon with a rock-climbing lift kit that’s in my co-editor Jim Wood’s garage right now was purchased with the assistance of CarGurus.

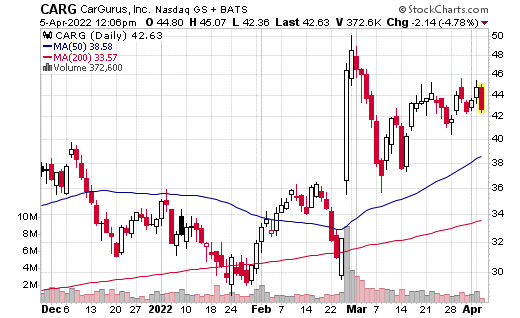

Of course, for a stock to make it into the Fast Money Alert family, it must have just that, some fast money behind it. And when you look at the data, you see that year to date, CARG is up 26%. In the past 52 weeks, shares have accelerated some 73%. That performance puts CARG in the top 3% of all stocks in the market on a relative strength basis.

Technically speaking, CARG shares now are forming a next-stage base right around the $42-43 range, and today’s pullback tells us that if we enter today, we are likely to see that added upside in the shares when buyers step back to buy the shares in front of the next catalyst for the stock. This is the company’s scheduled May 5 earnings release.

So, let’s buy CarGurus at market with a protective stop set at $34.10. For those who are willing to make a bigger bet, we recommend the CARG Aug. $45.00 call options at market. Those call options last traded for $4.80 and expire on Aug. 19.