It's been a rough couple of months for blue-chip home improvement retailer Home Depot (HD); but our historical studies suggest the stock may be the best blue chip for options bulls this month, asserts Lillian Currens, deputy editor at Schaeffer Investment Research.

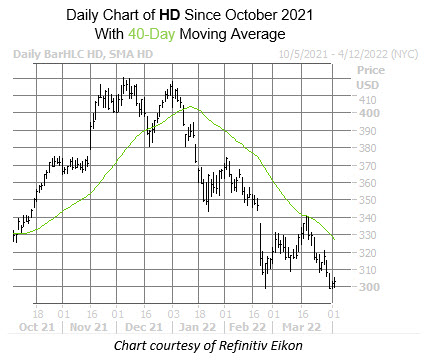

Shortly after the company suffered a post-earnings selloff in February — made even worse by a beat-and-raise from top competitor Lowe's (LOW) — the security hit an eight-month low just above the $299 level.

While Home Depot stock managed to distance itself from this rout, the 40-day moving quickly sent the stock to even more lows late last week. However, hope might not be completely lost, as the equity has seasonality on its side, which could help guide HD to a win in April.

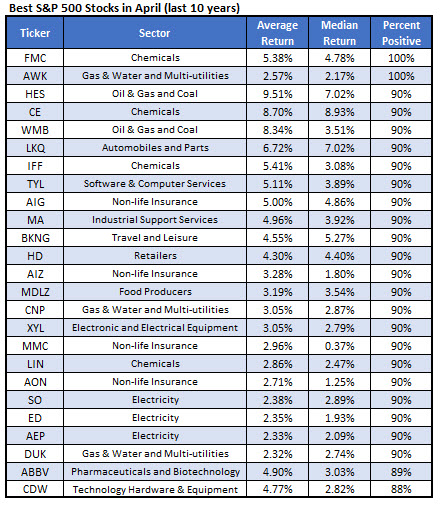

To be more specific, Home Depot stock just landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of S&P 500 stocks with the best returns in April, going back 10 years. According to this data, Home Deport stock enjoyed positive one-month returns 90% of the time, averaging a 4.3% jump in this time period.

From HD's current perch of $303.17, a similar move would put the shares back atop the $316 level. And while these gains look relatively muted compared to some others on the list, the equity is the only blue-chip stock and member of the retail sector that made the cut.

An unwinding of pessimism in the options pits could put additional wind at the equity's back. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), HD sports a 50-day put/call ratio of 1.25, which sits higher than 91% of all annual readings. In other words, long puts are being picked up at quicker-than-usual clip.

It might be the ideal time to speculate on HD's next move with options, too. The stock's Schaeffer's Volatility Index (SVI) of 48% sits in the lowest quartile of its 12-month range.

In other words, options traders are pricing in relatively low volatility expectations right now. What's more, the stock boasts a Schaeffer's Volatility Scorecard (SVI) of 91 (out of a possible 100), implying HD tends to outperform said volatility expectations.