The Option Advisor has been the flagship newsletter of Schaeffer Research since 1981. Here, editor Bernie Schaeffer offers two options plays — both in the healthcare sector.

Pharmaceutical retailer CVS Health (CVS) has solidified itself as an outperformer, adding roughly 47.5% over the last 12 months, and releasing a sunny full-year forecast earlier this month.

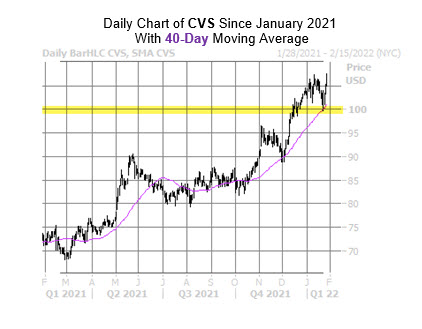

Plus, a recent pullback on the charts brought the equity a hair's breadth away from its 40-day moving average, which runs near its 2021 closing level, and the round $100 area. That trendline has resulted in bullish quantified results in the past, making now the perfect opportunity to initiate a new long position on CVS.

An unwinding of pessimism could help CVS Health stock move higher still, as short interest added 45% from early December to January. Now looks like a good time to hop on board with options, too, as CVS's Schaeffer's Volatility Scorecard (SVS) sits at a relatively high 72 out of 100. This indicates security has exceeded options traders' volatility expectations in past year.

RECOMMENDATION: Buy the May 20, 2022 105-strike call.

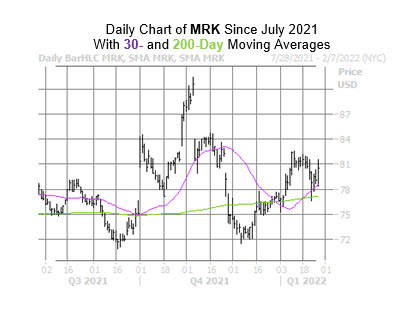

Blue-chip pharmaceutical giant Merck (MRK) has toughed out broad-market headwinds to add over 10% since early December, with a breakout above the 200-day moving average occurring late last year.

The stock sports healthy year-to-date and year-over-year leads, with its 30-day moving average capturing the latest pullback ahead of a Feb. 3 earnings report. The stock’s resiliency has been apparent – the shares bottomed out just weeks after SEC filings revealed Warren Buffet had closed his position — and this could lead to analyst upgrades, as nine members of the brokerage bunch still consider the stock a "hold."

A shift in sentiment among options traders may be imminent as well, as MRK sports a 10-day put/call volume ratio of 0.98 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). The last time this ratio neared 1.0 was in June 2021, an intermediate-term bottom for the stock.

RECOMMENDATION: Buy the April 15, 2022 80-strike call.