Are brick-and-mortar stores on the way out? suggests Jim Woods, exchange-traded fund specialist and editor of The Deep Woods.

After all, with the shift to online retail companies as a result of the COVID-19 pandemic, it seems like the old American pastime of going to the mall in order to buy the goods that we want or need may be ending.

The data seem to support this conclusion, and an article by Coresight Research claims that, “25% of America’s roughly 1,000 malls will close over the next three to five years.”

One exchange-traded fund that will likely be unaffected by the rise of so-called “dead malls” is IBUY Amplify Online Retail ETF (IBUY). This ETF tracks an index of global stocks issued by companies that earn a majority (at least 70%) of their revenue from online retail stores.

While companies can be of any market capitalization, American firms receive a minimum 75% weight. Foreign companies receive the rest. Such a procedure keeps the whole portfolio from being dominated by Amazon.

Currently, the fund’s top holdings include Amazon (AMZN), Expedia Group (EXPE), Liquidity Services (LQDT), Groupon (GRPN), Etsy (ETSY), Copart (CPRT), Airbnb Class A (ABNB) and Booking Holdings (BKNG).

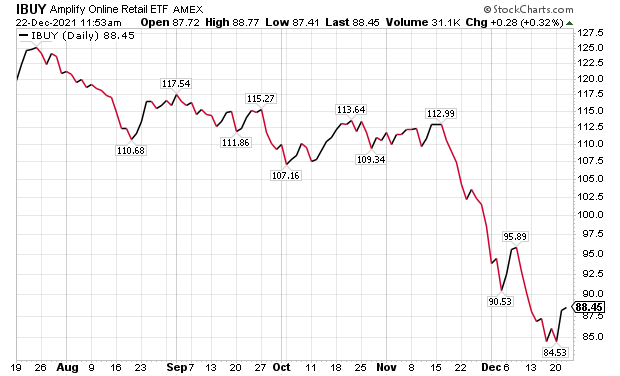

This fund’s performance has been problematic, especially when including the damage done by the COVID-19 pandemic. As of Dec. 21, IBUY has been down 17.94 over the past month and down 22.87% year to date. The fund has amassed $633.57 million in assets under management and has an expense ratio of 0.65%.

In short, while IBUY does provide an investor with a way to profit from online retail stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.