The SPDR S&P Retail ETF (XRT) tracks a broad-based, equal-weighted index of stocks in the U.S. retail industry, notes Jim Woods, exchange-traded fund specialist and editor of The Deep Woods.

XRT uses equal weighting rather than market-cap weighting to make radical differences in exposure and performance compared to its peers.

The effect of equal weighting in XRT is keener than some other equal-weighted funds because it draws retail stocks, as defined by GICS, from the broad S&P Total Market Index that includes equities of any market capitalization.

The result is that XRT has greater micro- and small-cap exposure. The fund holds retail companies that stretch across multiple sub-industries such as apparel, automotive, computers and electronics, department stores, drugs, food, general merchandise stores, hypermarkets and super centers, internet and direct marketing retail, and specialty stores. The index is rebalanced quarterly.

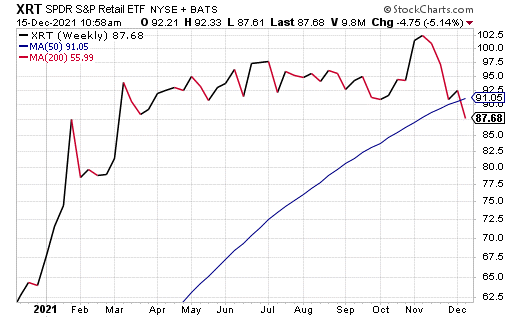

The fund has $971 million in net assets and a 0.02% average spread. Its expense ratio is 0.35%, meaning it is relatively inexpensive to hold in comparison to other exchange-traded funds. XRT’s share price, as of mid-December 2021, is just under $90, giving it a 0.68% distribution yield.

The investment seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of an index derived from the retail segment of a U.S. total market composite index.

In seeking to track the performance of the S&P Retail Select Industry Index, the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, of its total assets in the securities comprising the index.

If this checks all the boxes an investor is looking for, then this could be a good investment. However, as with any opportunity, I urge all interested parties to exercise their own due diligence in deciding whether this fund fits their own individual investment and portfolio goals.