The market faces several obstacles for next year. Valuations are rich and year-over-year economic and corporate comparisons will be nowhere near as easy as this year versus the 2020 pandemic numbers, explains Jeffrey Hirsch, seasonal timing specialist and editor of Stock Trader's Almanac.

While the Fed has promised patience and a slow pace it is now rather clear that they will be making a concerted effort to remove quantitative easing by mid-year and begin slowly raising rates.

This punchbowl of free money sloshing around and the past decade or ZIRP (zero interest rate policy) has been feeding the bull and allowing valuations to get historically high. When the Fed Kool-Aid is gone the party is likely to quiet down. We are not expecting anything sinister or a deep nasty bear market, but a reversion to the mean and a decent correction cannot be ruled out.

Market internals and technicals are also concerning as we have failed to break out to new highs since the beginning of November – S&P did make a marginal new high, but it has not held yet. As the old Blood, Sweat & Tears classic track “Spinning Wheel” taught us: “What goes up must come down.”

There are also some geopolitical concerns as Russia masses troops on the Ukrainian border, basically challenging NATO and the U.S. In the recent video summit Putin and Xi Jinping exuded solidarity and planned a meet and greet at the Olympics.

Meanwhile China continues to stiff-arm the U.S. on many fronts as the West snub China on the Olympics. Iran and North Korea continue building their nuclear capacity and foment hostility.

But imminent pressure on the market is most likely to come from Washington as is often the case in the battleground that is the midterm election year.

President Biden’s approval rating has plummeted since the botched withdrawal from Afghanistan and many are not pleased with how he is handling international affairs and are opposed to Covid mandates. All this has hardened Republican opposition and is likely to boost their resolve and support in the midterm elections. And that is what makes midterm years a bottom picker’s paradise.

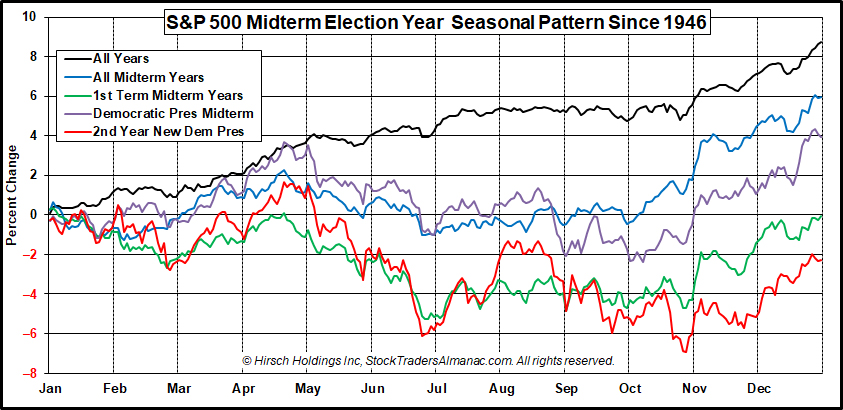

Along with the pattern for all years and all midterm years since WWII we have overlaid the patterns for 1st term midterm years, Democratic president midterm years as well as the 2nd year of new Democratic presidents.

All midterm years average an S&P 500 gain of about 6%, Democratic president midterm years average about 4%, but 1st term midterm years average a loss of -0.6% and the 2nd year of new democratic presidents have been down -2.3% on average. All four tend to hit an early year high in April at the end of the Best Six Months with a low point during the Worst Six Months May-October.