With rates rising, widespread tax-loss selling and fund manager’s either closing the books for 2021 or just closing down altogether, the market has entered a major risk off phase and biotech stocks are the ultimate whipping boy, explains John McCamant, biotech sector specialist and editor of The Medical Technology Stock Letter.

Other than the leading vaccine stocks which have boosters and the omicron variant on their side, there are very few sector stocks even flat for November. Forced liquidation has led to many stocks trading under their cash levels — usually a sign that things cannot get much worse. It should be understood there is a 30-day waiting period before stock sold for tax purposes can be re-purchased.

Technically, biotech stocks have officially entered “oversold” levels and may remain there until the tax-loss recoup periods are over. Despite the ASH meeting approaching, there is no really incentive for fund managers to chase anything at all, especially not knowing the amount of potential drawdowns until 2021 ends.

Survival is the number one priority for money managers. Usually, there is some year-end bounce but this year has seen one of the greatest puking of biotech stocks ever — and not for fundamental reasons. That’s what keep most fundamentalists like us frustrated and still holding on. Stocks don’t stay oversold forever when fundamentals are intact and/or improving.

Clearly the charts are horrific — but clinical and technological progress and hence fundamentals are positive. The vast majority of companies are well funded, and we are likely to see a wave of M&A activity with the abundance of growing cash hoards at Big Pharma/Big Bios.

Despite all the reasons we have given that biotech stocks are being crushed — too many companies, biotech hedge funds closing, tax-loss selling, omicron, rotation to other sectors, Biden drug pricing plan — one major reason above all for that weakness is most likely the rise in interest rates.

In a sector that values itself on mostly hypothetical long-term sales/earnings forecasts, any small shift in the discount rate results in a meaningful change in NPVs. Hence in a world of rising inflation and real risks of higher interest rates, biotech stocks are being sold indiscriminately likely due to increased perception of a higher risk premium investors require for buying these stocks.

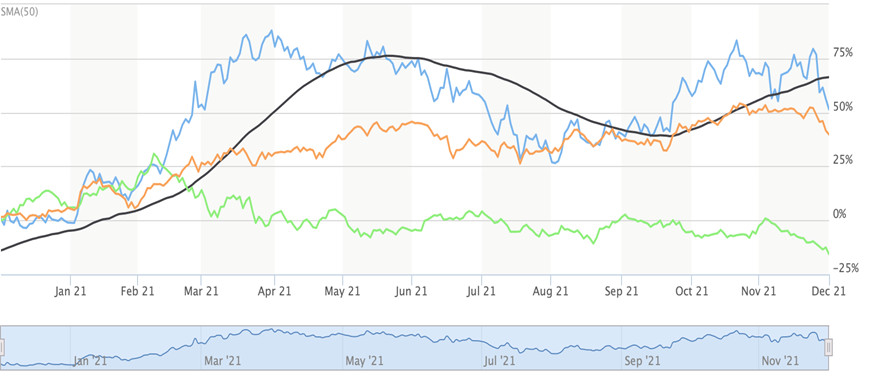

While not a perfect correlation, the chart above shows that when rates rise, biotech stocks underperform and vice versa. The time that is most pertinent appears to be beginning of this year when rates, although historically low, spiked sharply from February to March. Biotech stocks have never recovered and have sold off steadily and underperformed since.

Over the same time, interest rate sensitive bank stocks have led the market (and had previously underperformed). Should this omicron variant lead the Fed to reconsider its recent declaration against inflation, we could see a rally in the bios, especially as the year ends and all the selling that comes with it concludes.

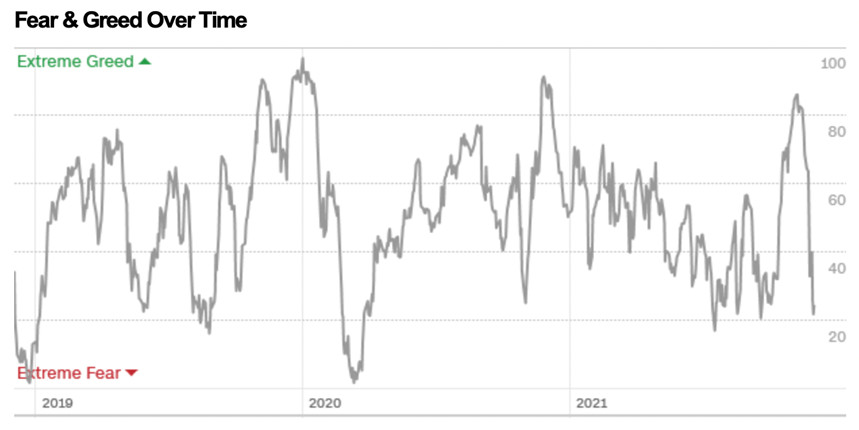

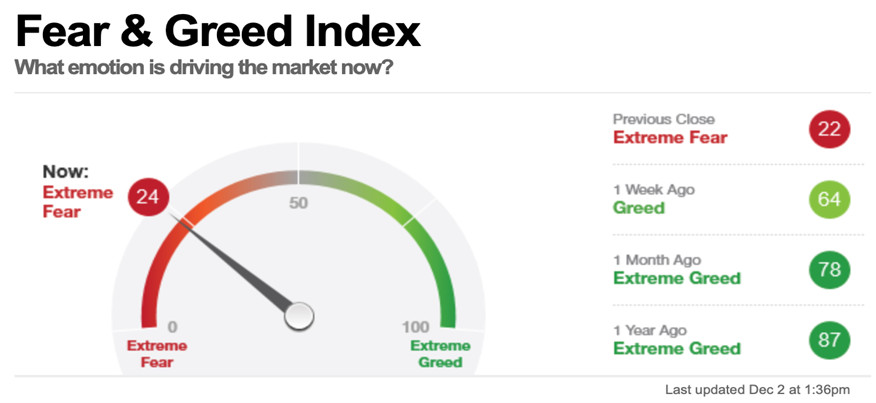

The market’s F&G index closed at 24, declining below EXTREME FEAR levels (25) for the first time since this summer. In our view, biotech stocks have lived in EXTREME GREED for a while now and we would be buying the XBI here while blood is in the biotech streets. Can it stay there for a while?

Certainly but with the overall market finally reflecting that fear, we believe the risk/reward here for biotech stocks has created a real opportunity — possibly until the end of the year. However, with all the cash at Big Pharma/Big Bio and the fact that forced selling — and NOT fundamental selling — is occurring daily in many names, tells us that we are much closer to the bottom than we have been in a very long while.