We started banging the drum on inflation early this year; over the course of the year, more analysts and observers began to join us in identifying the rising risk of more troublesome and persistent inflation, notes Marty Guild, money manager and editor of Guild Investment Management's Global Market Commentary.

By late summer, the consensus had firmly shifted to the “persistent” camp, but the Federal Reserve maintained its position that inflation would not be lasting or create lasting damage to the economy.

Finally, Fed Chair Jerome Powell has admitted that “the risk of higher inflation has increased,” said that it was probably time to “retire” the word “transitory,” and suggested that the central bank would consider accelerating the tapering of current asset purchases.

The Fed’s heel-dragging is both understandable and historically predictable. The element of caution (not to say fear) that prompted the epochal liquidity tsunami last April has also prompted the Fed to keep easing long after a chorus of respected voices were calling them to begin the taper. However, the simple truth is that the Fed has a nearly perfect track record in being too late.

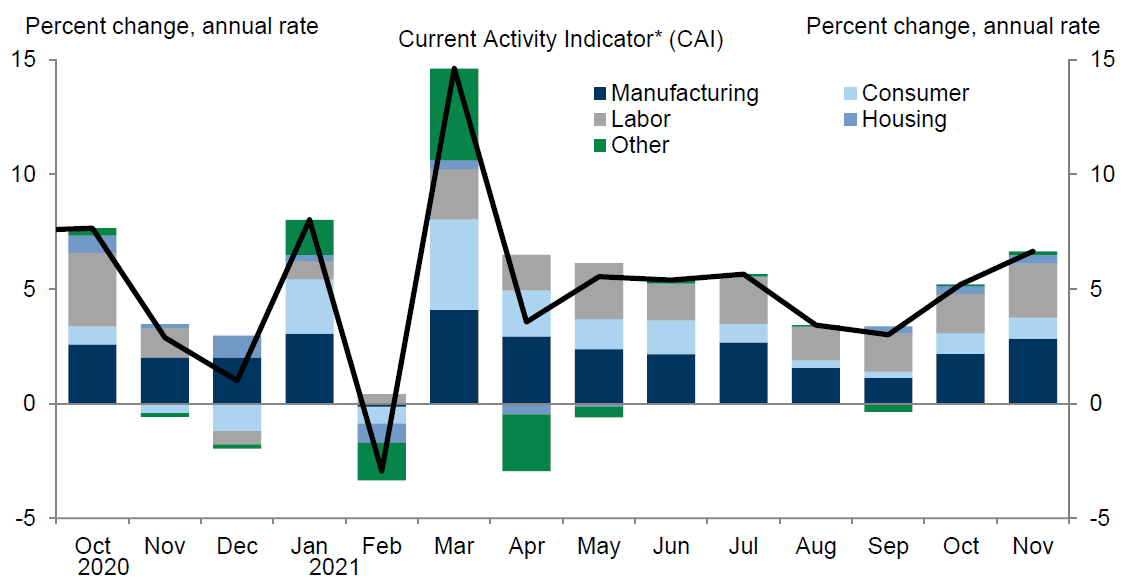

Initiating the taper would have been advisable over the summer, when growth and anticipated growth were even higher than they are now. But still, although some indicators have decelerated, the U.S. economy is doing well, in spite of current inflation. The chart below shows current activity — a real-time GDP proxy of 37 different economic indicators — rising to 6.6% annualized in November from 5.5% in October:

Source: Goldman Sachs Research

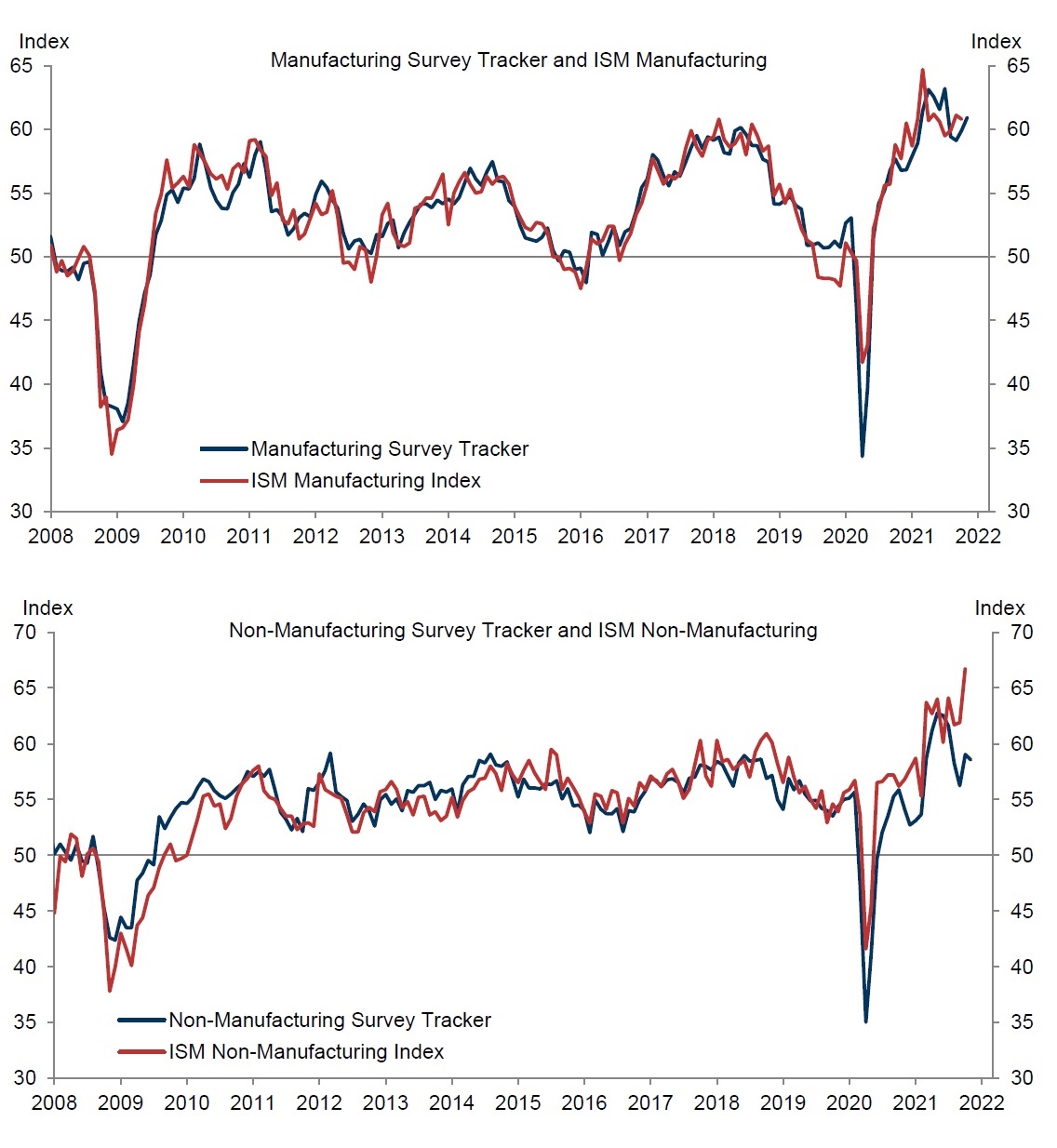

Both manufacturing and non-manufacturing surveys of purchasing managers show deceleration from peak optimism, but remain firmly in growth territory.

Source: Goldman Sachs Research

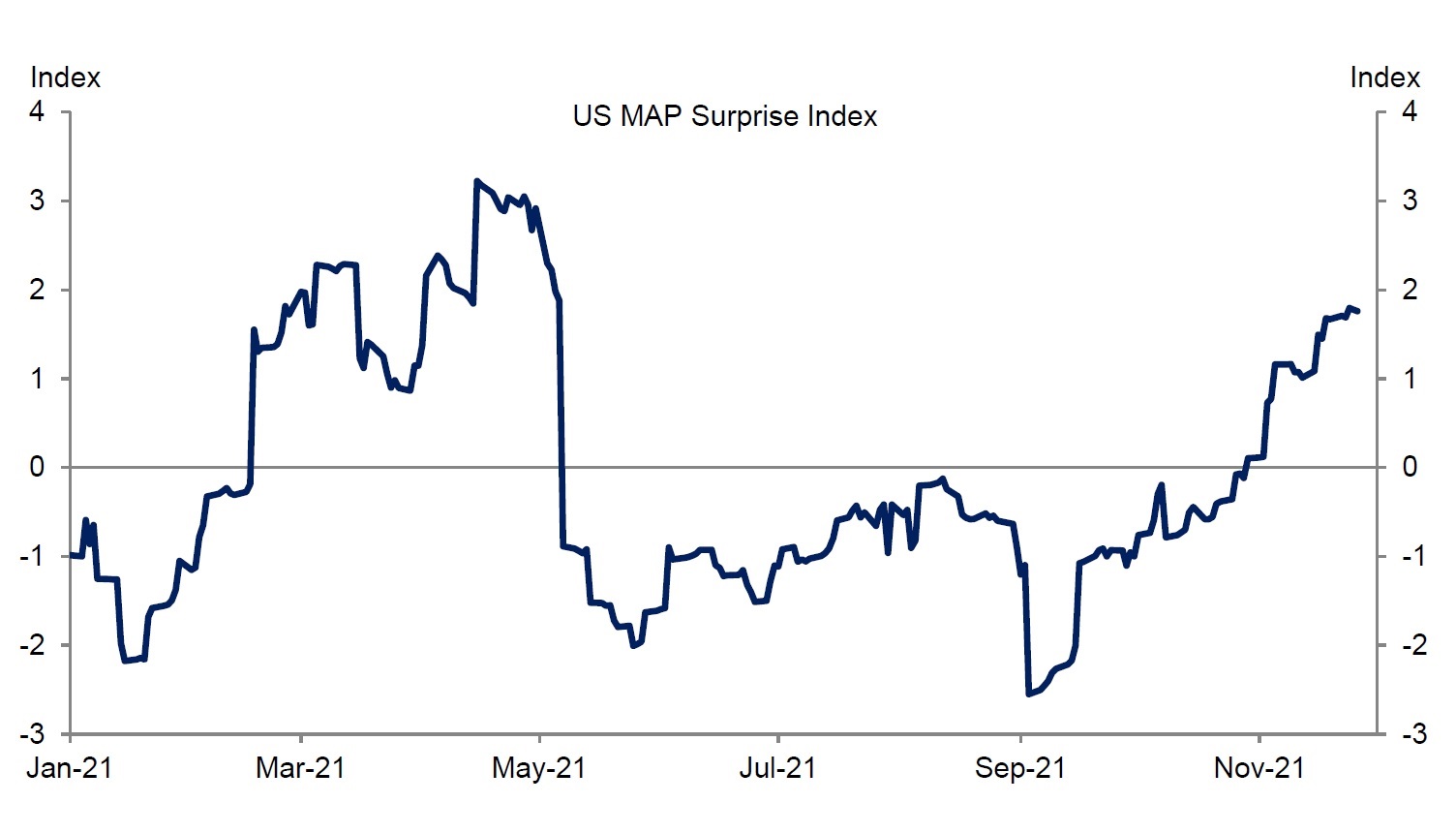

And a composite of economic “surprises” (data coming in better than expected, weighted for significance) also shows a decline relative to the first half of 2021, but remains positive, and accelerating from recent lows.

Source: Goldman Sachs Research

Growth and economic vitality are not the central question now; the central question is inflation. We think that Chairman Powell has acted late to lay the psychological groundwork for the withdrawal of pandemic stimulus… late, though perhaps not too late.

What is essential is for the Fed to forestall the commencement of a wage-price spiral. Recently we wrote about how current pandemic-driven labor shortages have emboldened labor. Should wage expectations get baked into labor psychology — which may already be underway — the cascade would see prices rise as companies act to defend their margins, leading to more demand for higher wages, and so on.

The omicron covid variant has arrived just in time to make life more difficult for the Fed as it tries to engineer a “soft landing” from pandemic stimulus. The data we have seen so far — which are limited — suggest that this variant will likely be more transmissible and less pathogenic than previous covid strains. That would be a normal pattern in the evolution of a novel respiratory virus; too much lethality is a detriment from the virus’ perspective, as it hinders transmission.

In many countries in Europe, the policy response has already been an overreaction relative to the available data, and the Fed is certainly aware that there is the chance of another round of supply-chain snarling lockdowns, travel restrictions, and the like. (We believe this outcome is unlikely, but possible.)

There is also the chance that public anxiety will cause labor-force participation to remain suppressed and contribute to continued supply issues — even as fiscal and monetary stimuli remain in force. Taken together, these converging forces pose the risk of stagflation, and thus, in spite of congenital caution, seem to have forced the Fed’s hand.

For investors, the real issue is simply that, one way or another, interest rates should rise, and that spells trouble for stock price-to-earnings multiples, especially for very high or infinite multiple meme and theme stocks, where retail buying has been intense and more or less uncluttered with traditional analysis of addressable markets, sales, and earnings growth.

Rampant speculation in meme stocks, SPACs, and companies with no earnings expected for five or six years, is a classic picture of an over-speculative stock market environment.

Interest rates have been deeply clouded by extreme monetary and fiscal policy — of that, there is no doubt. They no longer serve as signals of economic risks and expectations, as they are increasingly underpinned by non-economic motivations: compliance with the politically colored technocratic programs of governments and central banks.

Still, in spite of the rising costs imposed on indebted government by rising long-term rates, the Fed cannot, and ultimately, we believe, will not, sit idly by and watch inflation embed itself in economic psychology. That will have consequences for stocks.

Investment implications: Above all, investors need a plan for an inflationary and rising-rates environment. There are a variety of inflation-hedging instruments and strategies: gold and other precious metals, broader real asset exposure, cryptocurrencies, inverse fixed-income ETFs, options strategies for sophisticated investors, and the like.

While growth stocks can also perform well in an inflationary environment, rising interest rates pose a general risk to stock price-to-earnings multiples — a risk significant enough to eclipse rapid growth in sales and earnings. Certainly, stocks that have depended wholly on analysis-free retail momentum and speculative fervor will not fare well as this process unfolds. Caveat emptor.

As the economic environment evolves over the coming year, it is likely that different stages of the process may call for strategy changes and new allocations, so investors should not imagine that a fix-it-and-forget-it “autopilot strategy” will be effective.

This is all the more true given the unpredictability of the Fed’s response, and the possibility — already anticipated by the bond market — that it will make a policy mistake and resort to more drastic rate increases if inflation becomes more endemic in 2022.

A final area of risk is a massive over-speculation in some speculative areas of software connected with 5G, the cloud, cybersecurity, and some other areas. We are happy to see the current correction in the market, because it is removing some of these excesses — which must be removed before the market can move steadily higher.

Subscribe to Guild Investment Management's Global Market Commentary here…