Eagle Point Credit Company (ECC) is a closed-end fund that invests in CLOs (collateralized loan obligations). CLOs are bundles of corporate bank loans that are "securitized" and sold to investors, explains Rida Morwa, editor of High Dividend Opportunities.

This means that instead of buying a single loan, each investor is buying a small piece of hundreds of loans. This helps even out the variance caused by credit defaults because a bundle of loans is more likely to be "average" than just a single loan. Today, the CLO sector is one of the hottest sectors in the United States with substantial growth potential.

CLO managers will sell pieces of the loans on a priority basis, which means that investors willing to pay a substantial premium can get the senior "A" tranches. These investors pay extra for the guarantee that they're paid before other investors. Since no A-tranche has ever defaulted, the A-tranches for CLOs sell at very high prices (and low yields).

In 2021, there's already a record annual issuance of new CLOs. With A-tranches selling like hotcakes to institutional investors who are starving for yield, like banks and insurance companies, there's a surplus of supply for the junior and equity tranches — those tranches that agree to be paid last. CLO managers are raking in the profit from the A-tranches, and they just want to dump the lower tranches to free up capital.

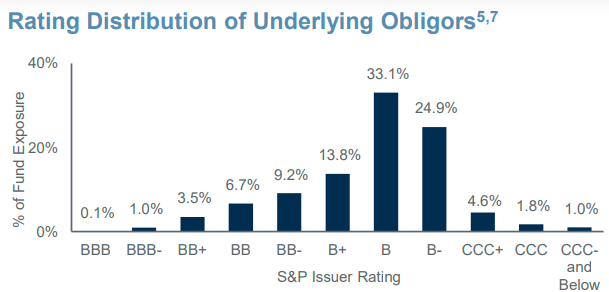

This is where ECC comes in. Like a smart bargain hunter, ECC recognizes that the prices of the equity tranches are extremely low and extremely high yielding. These are senior-secured loans to companies that are often publicly traded and have B credit ratings.

Source: ECC September 2021 Portfolio Update

Who are these companies? Well, here's a list of ECC's top 10 borrowers. You probably recognize more than a few names. These are companies with very similar credit ratings, as you might see in a high yield corporate ETF. However, loans that are in the CLOs that ECC owns are higher up the capital stack. They're senior to the publicly traded bonds that high yield corporate ETFs own.

Usually, when you move up the capital stack, yields get lower. Thanks to the low accessibility of the CLO market, and the very few buyers of CLO equity positions, these investments have not seen the major yield contraction we have seen in other debt investments. CLO equity yields are about the same today as they were in January 2020.

The bad news is that retail investors can't just buy CLO equity positions. There's no public market to go to buy and sell them. The good news is that ECC can, and we can easily invest in ECC and get a very generous yield.

After all, if CLO equity positions could be bought as easily as bonds, they would probably be a lot more expensive! To top off ECC's generous regular dividend, ECC recently announced a special year-end dividend of $0.50 per share, ex-dividend Dec. 22.