Electric vehicles (EV) have been making the rounds of news headlines, both on and off of Wall Street, notes Emma Duncan, managing editor at Bernie Schaeffer's advisory service, Schaeffer Research's Chart of the Week.

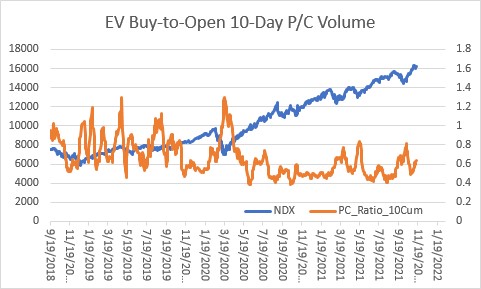

For example, President Biden’s Build Back Better program that just recently passed the House provides a $12,500 tax credit for electric vehicles. On Wall Street, EV stocks have been buzzing, sending its buy-to-open 10-day put/call volume ratio higher since September.

Senior Market Strategist Chris Prybal provided a chart — see below — showing the aforementioned ratio alongside the Nasdaq-100 Index (NDX). It’s worth noting that the 10-day ratio on EV names is above 0.60 — which could be a contribution of the recent market shift at Tesla (TSLA). However, the other readings or ratios on other baskets is around 0.30 or 0.40.

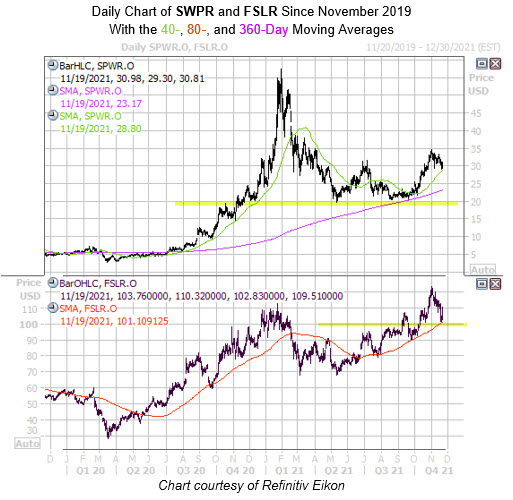

While the list of electric vehicle stocks is ever growing, alternative energy stocks have been around a little longer and thus can be seen as slightly more stable at the moment. For example, two note-worthy names worth exploring are First Solar, Inc. (FSLR) and SunPower Corporation (SPWR).

What’s more, both of these alternative energy disruptors showed up on a list of stocks that are now flashing a historic bull signal. Below, we will take a closer look at what this could mean for bulls who want to bet big on the sector.

SunPower stock has added 20% in 2021, with its recent round of lower highs finding a leg of support at both the 360-day moving average and the round $20 level. Meanwhile, First Solar stock has added just over 9% this calendar year, and has seen a trendline of support near $103 in the last few weeks.

SunPower stock has pulled back to its 40-day moving average, after spending a significant period of time above it. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, a notable seven similar signals have occurred during the past three years.

The security saw a positive one-month return 71% of the time, averaging a 6.4% gain. Last seen at $30.45, a similar move would put SPWR above $32 — just below its six-month highs.

For First Solar stock, the equity recently pulled back to its 80-day moving average, after spending a significant period of time above it. Per White, five similar signals have occurred during the past three years.

FSLR enjoyed a positive one-month return in 80% of those cases, averaging an impressive 9.8% gain. From its current perch of $106.65, a similar move would put the security back above the $117 level, within a chip-shot of its 10-year peak.

Both stocks also look ripe for a fresh round of bullish attention too. Of the 14 and 11 analysts following FSLR and SPWR, respectively, seven and 10 carry tepid "hold" or worse recommendations. In simpler terms, this leaves ample room for upgrades, should these trendlines prove to be historical springboards.

Short interest has been building on SunPower stock, too, up 11.3% during the past two reporting periods and now accounting for nearly 21% of the stock’s total available float. At the equity’s average pace of daily trading, it would take shorts the better part of a week to buy back their bearish bets.

First Solar and SunPower options also look affordable from an options standpoint. Their respective Schaeffer's Volatility Index (SVI) readings of 44% and 61% stand higher than just 36% and 5% of all other readings in their annual range, implying that options players are pricing in relatively low volatility expectations at the moment.

Whether you believe in the staying power of alternative energy or not, contrarian traders look for value wherever it can be found. Options allow traders to place fewer dollars at risk, thus lowering the cost of entry. This means dart throws on stocks that look toward the future suddenly become a potentially lucrative play.