Although headquartered in Mexico, Cemex (CX) is one of the biggest sellers of cement, concrete, and aggregate in the United States, notes Jim Pearce, chief investment strategist of Investing Daily's flagship newsletter, Personal Finance.

Over the first nine months of this year, Cemex racked up more than $11 billion of net sales. That was 17% higher than last year and consistent with the company’s guidance for this year.

The new home construction boom that drove the price of materials higher in the U.S. certainly helped Cemex’s operating margins during the first half of this year. But now that those prices have receded to their previous levels, the global supply chain bottleneck is squeezing the company’s operating margins as shipping costs have jumped during the second half of this year.

In the third quarter, Cemex’s operating EBITDA (earnings before interest, taxes, depreciation and amortization) narrowed from 21.2% to 19.6%. However, the company expects that metric to rebound back above 20% next year once the supply chain issues have been resolved.

And now that demand for its products should escalate as a result of the new construction projects funded by the infrastructure spending bill, 2022 could be a banner year for Cemex.

Cemex released its fiscal 2021 Q3 results and guidance on October 28, one week prior to the passage of the infrastructure spending bill. That would not have influenced its guidance for the remainder of this year but will have an impact on its expectations for 2022 and beyond.

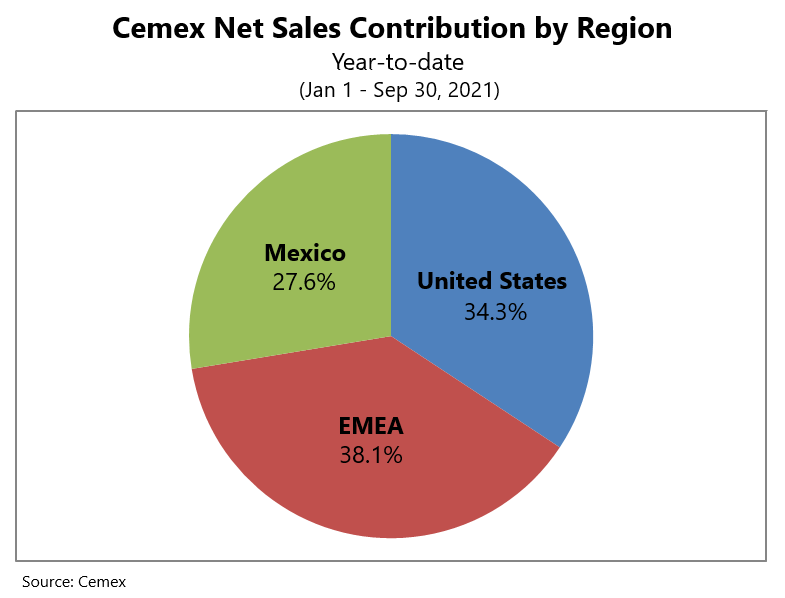

However, the U.S. accounts for roughlyhd oCemex’s net sales, so its performance next year will also depend on construction spending overseas. Its biggest market is the EMEA (Europe, Middle East, and Africa), which produced 38% of the company’s net sales so far this year while Mexico contributed 28%.

Net sales in its EMEA region were up 8% over the first nine months of this year, but during the third quarter they increased only 1% while sales in the U.S. and Mexico jumped 10%.

That may be due to supply chain bottlenecks and an alarming resurgence of COVID-19 in Europe that has slowed construction activity, in which case Cemex’s net sales could jump considerably in 2022. Cemex remains a buy up to $10 a share.