The fast money always flows to where the market's energy is — and now, that fast-money flow will literally take us to the energy sector, suggests Mark Skousen, editor of Fast Money Alert.

Oil and natural gas prices have surged due to a combination of supply and refinery output, increased demand and expectations for a cold winter.

This combination has been particularly bullish for natural gas, as the energy commodity has seen its price soar to multi-year highs. Indeed, the fast money has flowed into “nat gas,” as well as the stocks tied to its fortunes.

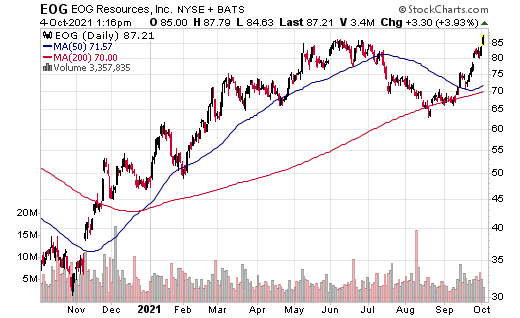

Today, we are going to let the fast-money energy flows fire up our own new energy play in the form of EOG Resources, Inc. (EOG) — an oil and gas producer with acreage in several U.S. shale plays, including the Permian Basin, the Eagle Ford and the Bakken.

At the end of 2020, it reported net proved reserves of 3.2 billion barrels of oil equivalent. Net production averaged 754 thousand barrels of oil equivalent per day in 2020 at a ratio of 72% oil and natural gas liquids and 28% natural gas.

A recent story in Investor’s Business Daily called EOG the “Apple of Oil,” due to the company’s use of technology and big data to aid in drilling operations. This flattering comparison is nice, but what’s more flattering are the fundamentals.

For example, over the past several quarters, and several years, EOG has been a huge earnings performer, with earnings per share (EPS) growth in the top 8% of all public companies. And as for the share price, well, the stock’s 149% gain over the past 52 weeks also puts it in the top 8% of public companies in terms of relative price strength.

Technically speaking, the recent breakout of the bullish cup-with-handle technical pattern to a new 52-week high is right where we want to buy in, and that’s precisely what’s taking place today. The fast money loves EOG right now — and so do we.