What a deal; here’s a Hooker that will pay you. That would be Hooker Furniture (HOFT), a top-five leader in household and office/home office furniture, headquartered in Martinsville, Virginia, asserts Paul Price, a daily columnist with TheStreet’s Real Money Pro.

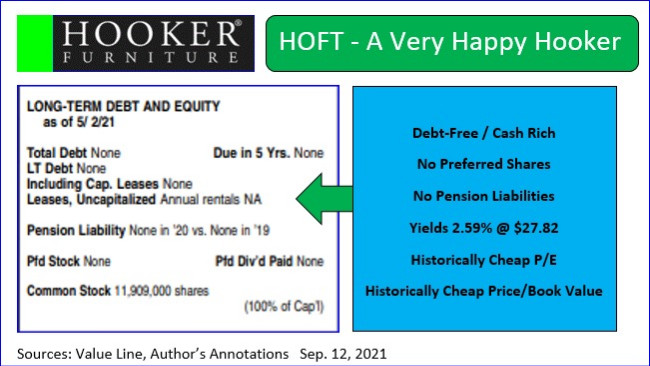

The company has a solid long-term growth record as noted below. Better still, it is totally debt-free, pays an almost 2.6% current yield. HOFT recently traded right at its YTD 2021 low.

Continuous shareholders since the start of 2014 have more than doubled their money on a total return basis. That good gain, though, represents just a fraction of the greater than 300% progress made in both cash flow and earnings per share over the last eight years.

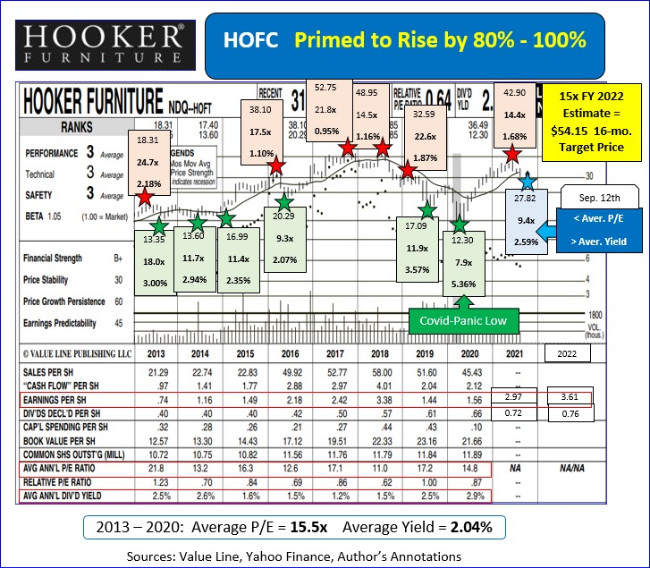

Hooker established an all-time high of $52.75 back in 2017 on EPS of $2.42. It changed hands at $42.90 as recently as June 4th, just a few months ago.

Following its end of July quarterly report HOFT’s trailing 12-month EPS sit at $2.97. That puts its current P/E at just 9.4x. Note, too, that Hooker is due to go ex-dividend for 18-cents per share this Wednesday, Sep. 15th.

The lone analyst covering the firm on Yahoo Finance see a new peak in EPS of $3.61 during FY 2022 (ends Jan. 31, 2023). All told Yahoo Finance’s 12-month goal price on HOFT now sits at $51.

There are many reasons to love HOFT at today’s quote.

Five of the six previous “best buying opportunities” on Hooker (green-starred below) launched major rallies from similar, or even more expensive valuations than todays. Buyers at the exact covid-panic bottom understandably paid a little less.

They were rewarded almost instantly with a trading move from $12.30 to $42.90 over the next 15-months. Each of HOFC’s “should have sold” moments (red-starred) reflected much higher valuations and far lower dividends than are now in place.

From 2013 through 2020 Hooker’s average multiple ran about 15.5-times. A simple regression towards the mean rebound to 15x would easily justify a mid-$50’s target price by around February of 2023 if earnings come in as expected.

Independent research firm Morningstar (MORN) does not have current analyst coverage on HOFT. Its computer-generated, present-day fair value estimate is now $37.70. That implies the shares are already about 35.5% below their true value.

FastGraphs is in full agreement. Their quantitatively derived Jan. 31, 2022 fair value estimate for HOFT sits at $42.60. Extend the time horizon out an extra year and they see the stock at $54.15, exactly in harmony with my own view.

Clearly, owning these shares appears quite attractive. Amazingly, in the 9-days from when Value Line went to press through Friday, Sep. 10, 2021 HOFT dropped from $31.84 to $27.82. That was a $40.02 per share decline (-12.6%) in the absence of any bad news.

You don’t often get chances like that except during periods when traders are getting spooked about the possibility for further market-related, as opposed to company specific, declines. Smart traders take advantage of those periods.

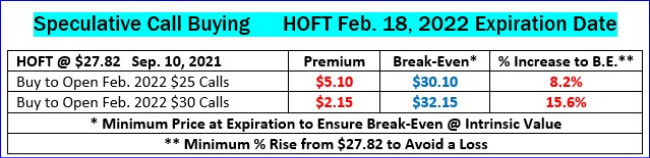

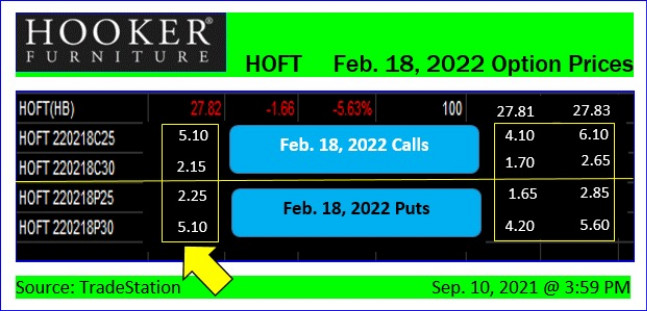

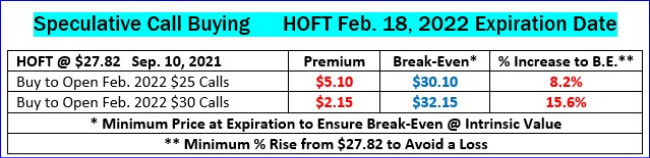

Option-minded traders can play HOFT via call buying or naked put sales. Actual pricing as of Sep. 10, 2021 on the Feb. 18, 2022 expiration date $25 and $30 strike prices is shown below.

Premiums are very attractive relative to what HOFT is really worth. Call purchase is always risky in that there is always the possibility for a 100% loss if things go badly.

While that’s true potential gains on these calls could be quite substantial if Hooker rebounds by February 18, 2022, as expected.

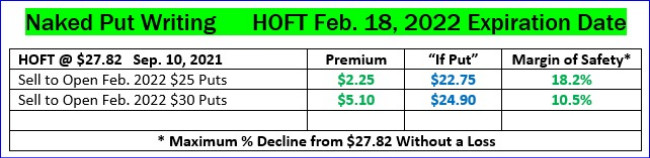

Selling naked puts is a much more conservative technique. That’s because you get a built-in margin of safety whenever you collect time premium. In the examples shown below they ranged from 10.5% to 18.2% in downside protection without incurring a loss. That’s especially amazing when you realize how cheaply valued HOFT is already.

The trade off on put writing versus call buying comes in the “capped” versus “uncapped” upside potentials.

Maximum profits on calls purchased is theoretically unlimited. Maximum gains on these, or any other, option sales is always limited to keeping 100% of all money received up front.

The YTD chart on Hooker Furniture shows that owning HOFT at either of the put sale break-even points would have been a winning position 100% of the time this year.

It also shows that even the more aggressive $30 call’s break-even would have been a winner for call option owners during the vast majority of this year. The $25 calls, at today’s price, would have been making money about 95% of the time this year so far.