Everyone is excited about gold, silver, palladium and the rare-earth metals, explains growth stock expert Sean Brodrick, editor of WealthWave.

Meanwhile, there’s a metal you probably use every day that’s chugging along, unnoticed — yet is headed for the supply-demand squeeze of the decade.

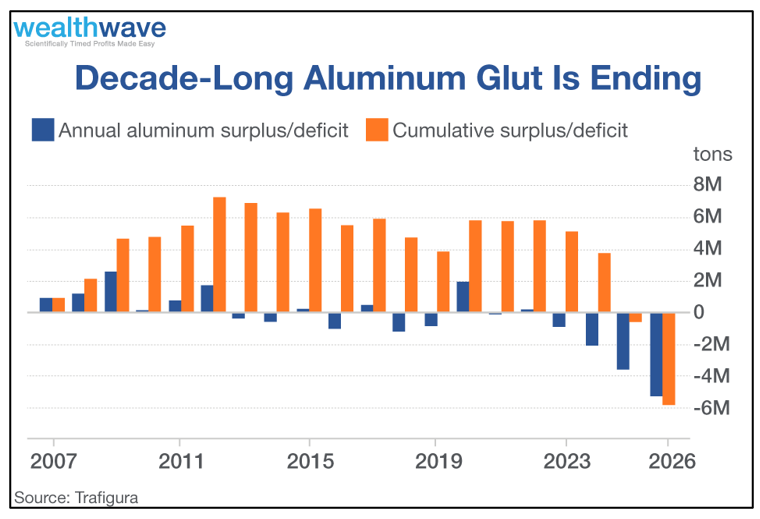

Whoa! The oversupply that’s been the aluminum market’s prevailing story for more than a decade is over, and according to metals trading giant Trafigura Group, a new era of scarcity is beginning.

Aluminum is used in everything from cars to Coke cans to houses. Because of its corrosion resistance, light weight, conductivity and mechanical strength, aluminum is also used for electrical applications (conductor alloys, motors, generators, transformers and capacitors) and in machinery and equipment (processing equipment, pipes, tools and more).

That’s quite the list! So, higher aluminum prices mean higher prices across the board for a variety of products, which in turn means inflation.

But why now? Trafigura implicates China, who’s dialing back aluminum production in an effort to reduce pollution. Beijing began cracking down in 2017, capping smelters at 45 million tons of aluminum production annually. The government keeps squeezing as it pushes for carbon neutrality.

The real squeeze comes in 2024 when China’s aluminum industry comes up against a hard ceiling. That’s when the aluminum deficit could rear its head.

If you don’t want to do all the research associated with picking individual stocks, you have two options. Let me tell you how to choose wisely!

The first is the iPath Series B Bloomberg Aluminum Subindex Total Return ETN (JJU). It has an expense ratio of 0.45%. I do NOT recommend you buy this fund for the simple reason that volume is terribly light, meaning you might not be able to sell it at the price you want.

The better choice is the Invesco DB Base Metals Fund (DBB). DBB tracks an index of three base metals’ futures contracts: aluminum, copper and zinc.

Sure, it’s only one-third aluminum. But copper and zinc are both soaring, making this fund a triple play of potential.

As the chart above indicates, DBB rallied this year. Converging trendlines are creating a wedge, meaning DBB is coiling up for a potential breakout. I believe the direction of that breakout is higher.

DBB has an expense ratio of 0.8%, and unlike JJU, it is very liquid. It’s an easy way to play the rally in aluminum and other base metals.