Interest rates are low, and there is a risk to bond investors if inflation rises, whether or not the Federal Reserve responds in a timely manner. Here I present some portfolio strategies with the goal of making the best of a low-yield environment regardless of whether we are headed for inflation, recession, or both, observes Marvin Appel, editor of Signalert Asset Management's Systems & Forecasts.

High yield and investment grade bonds diversify each other.

During financial crises such as February-March 2020 or 2008, all corporate bonds move lower in unison. However, such periods are rare. Most of the time they move in opposite directions. When economic conditions appear strong, high yield corporate bonds tend to do well because such environments improve the creditworthiness of risky high yield borrowers. On the other hand, bonds from investment-grade borrowers (for which the risk of default is low) do not benefit from high growth. Instead, they bear the risk that interest rates will rise, driving down the value of outstanding bonds.

Conversely, when the economy is at risk of slowing down, the riskier high yield borrowers experience the worst price declines because they are the canaries in the coal mine—likely the first to default if trouble strikes the economy. On the other hand, investment-grade bonds benefit from dropping interest rates that result from decreased demand for credit and lower inflation expectations.

The first portfolio I recommend combines both types of bond funds. Specifically, invest half of assets allocated to this strategy to the Wells Fargo Short-Term High Yield Bond Fund (SSTHX) and half to the Vanguard Total Bond Market Index Fund (VBMFX or VBTLX). This is a good portfolio for people who want to buy and hold.

I recommend SSTHX because it has been among the safest high yield bond funds during the major sell-offs of 2008 and 2020, suffering a drawdown of 14%. In comparison, TCW High Yield (TGHNX), itself a relatively quiet high yield bond fund, lost 35% at the worst extent of the 2007-2008 decline. Its current SEC yield is 2.3%, which is low in the high yield space but better than the 1.4% yield of VBMFX.

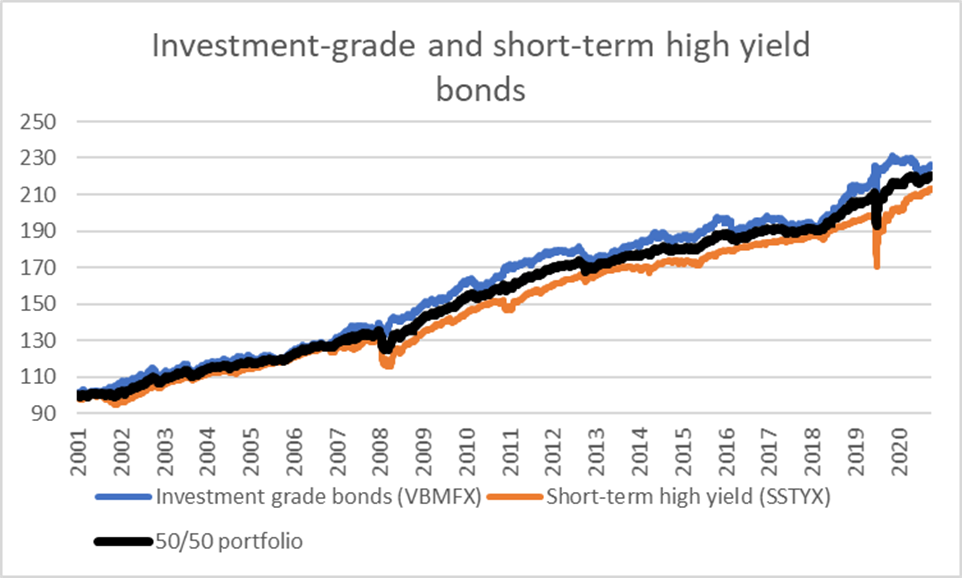

The chart below shows the growth of 100 invested in either fund separately or half in each of the two. The long-term returns over the past 20 years have been similar for all three funds: 4.2%/year for investment-grade bonds (VBMFX), 3.9%/year for short-term high yield (SSTHX) and 4.1%/year for the 50/50 portfolio.

Drawdowns (worst peak-valley percentage loss) were 6.5% for investment-grade bonds (VBMFX), 14.2% for short-term high yield bonds (SSTHX) and 8.7% for the 50/50 portfolio. The fact that the drawdown of the combined portfolio was less than the average of the two funds’ drawdowns demonstrates that diversification improved the risk-adjusted performance. The daily standard deviation confirms the benefits of diversification: The daily standard deviation was lower for the combined portfolio than for either fund separately.

Using high yield bond trading signals improves safety.

The SSTHX / VBMFX portfolio is a good option for those who want to hold bond funds for the long term. SSTHX is a fund that is not friendly towards traders, so if you are going to buy and hold a corporate high yield bond fund this is probably as safe a fund as you can find.

However, I strongly recommend trading high yield bond funds rather than buying and holding them: For quiet funds, major declines are infrequent but avoiding them can significantly improve results.

There are two trading strategies you can use. First, you can trade SSTHX according to the buy and sell signals that the newsletter provides for trading TCW High Yield (TGHNX). Doing so would not have had a big impact on return but would have reduced the drawdown of the combined SSTHX / VBMFX portfolio to 5.4%, less than the drawdown of buying and holding either investment-grade bonds (VBMFX) or short-term high yield bonds (SSTHX) separately. Buy and sell signals from TGHNX have been infrequent: 22 buys since 2001 and just two since 2016. TGHNX has been on a buy signal 78% of the time. This frequency of trading might be acceptable to SSTHX.

The best option for a safe bond portfolio

Alternatively, and better, you can construct your portfolio to buy and hold 50% in investment-grade bonds (VBMFX) and 50% in TCW High Yield (TGHNX), using the newsletter signals to trade TGHNX. Doing so would have returned an average of 6.1%/year from 2001-present with a drawdown of only 5.4%.

Looking forward, interest rates are unfortunately at historical lows. That means that the future returns from any bond program are likely to be lower than what would have been earned historically, at least until interest rates recover. In any case, the future performance of any investment program cannot be guaranteed.

Conclusion

Buy and hold investors should allocate half to investment-grade bonds (VBMFX) and half to one of the lowest-risk corporate high yield bond funds, Wells Fargo Short-Term High Yield Fund (SSTHX).

This portfolio can position you to get the most from a low-yield environment without increasing risk much beyond that of the investment-grade bond market.

However, the best risk-managed bond strategy could be to combine an allocation to half in investment-grade bonds (VBMFX) and half to trading the relatively safe corporate high yield bond fund TCW High Yield (TGHNX) according to the newsletter signals.

Subscribe to Signalert Asset Management's Systems & Forecasts here…