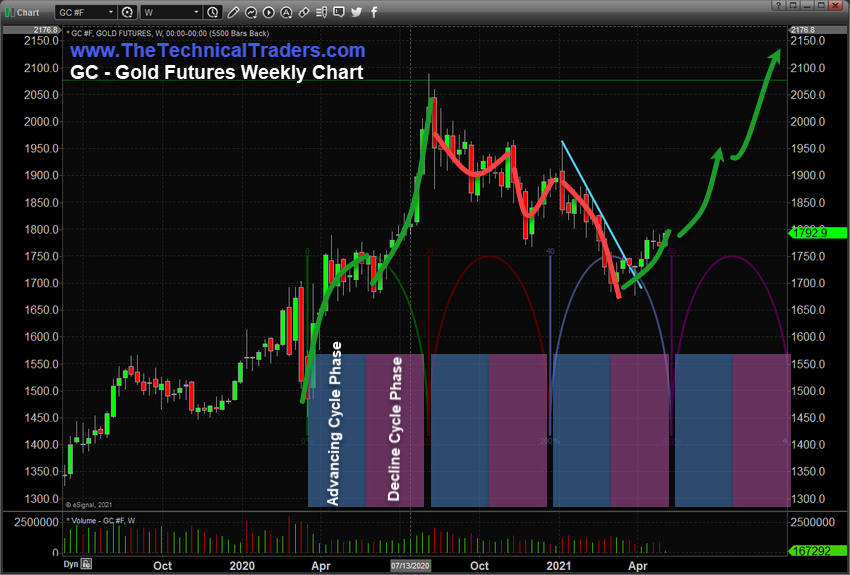

I want you to think of these cycle phases as Advancing and Declining cycle trends; they act as a “build-up of a trend,” then an “unwinding of a trend,” suggests Chris Vermeulen, editor of The Technical Traders.

In each instance, trends can be either Bullish, Bearish, or Neutral in nature. My research team and I believe a new Bullish Cycle Phase has begun in Gold and Silver. If our research is correct, the next Advancing Cycle Phase may prompt a broad rally in Gold and Silver.

We interpret these cycle phases as unique trend segments involved in a broader cycle scope. For example, over a longer-term rally, we may see many Bullish Advancing and Declining cycle phases take place — one after another.Conversely, we may see many Bearish cycle phases take place in an extended downtrend.

Another type of cycle phase can also exist, the Reversal Cycle Phase — where price Advances in one direction and Declines in the opposite direction. This type of Rotation Cycle Phase exists as the current completed Cycle on the Gold chart, below.

As we are nearing the end of the current Declining Cycle Phase as seen in the chart below, we will soon begin the new Advancing Cycle Phase in Gold. Gold’s Reversal Cycle Phase that took place between December 21, 2020, and May 10, 2021, will likely close higher than the midpoint (or Apex) of the total Cycle Phase.

This suggests a new bullish price trend has taken over and the price is more likely to move higher in the next Advancing Cycle Phase. If this trend continues, then the price will continue to rally higher in the Declining Cycle Phase as well — as we saw in the first Cycle Phase: between March 16, 2020, and August 3, 2020.

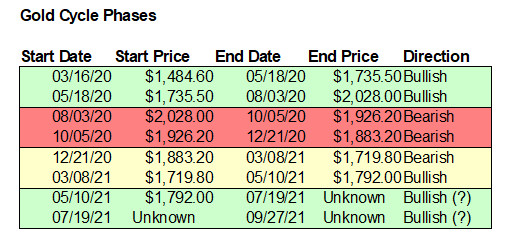

To help explain our Cycle research, we’ve put together these tables to detail the Cycle Phases and price logic we use to interpret each Advancing and Declining phase. Each table entry consists of an Advancing, then Declining Cycle Phase. Combined, they make up a complete Cycle Phase.

We are measuring price at the midpoint (Apex) of the Cycle Phase to determine if any Advancing or Declining Cycle Phase is Bullish or Bearish in trend. If both Advancing and Declining Cycle Phases show the same trend direction, we define that completed Cycle Phase as Bullish or Bearish. If they differ in trend types, we define that completed Cycle Phase as a Reversal Phase.

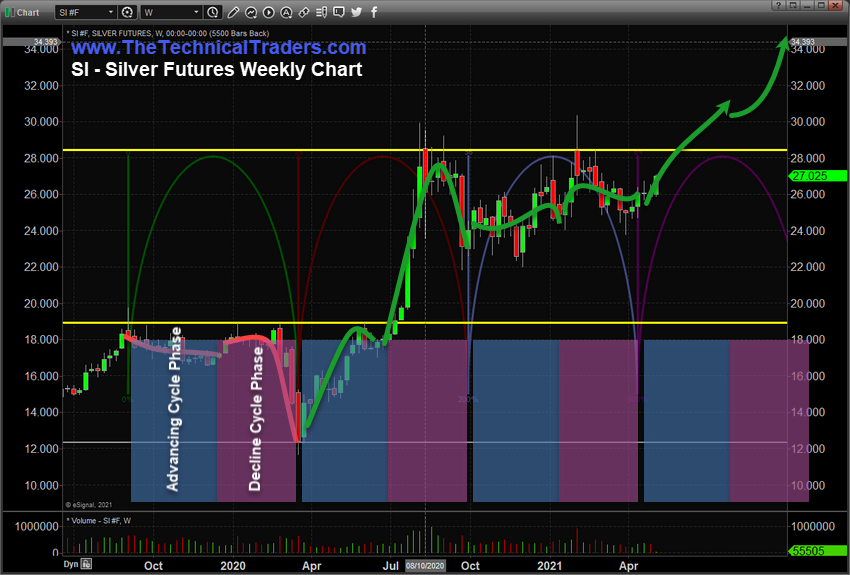

Gold has been in a downtrend recently while Silver has continued to stay somewhat bullish in a sideways price trend. You can see from the tables below, Gold recently completed a Reversal Cycle Phase (ending with a Bullish Declining Phase) while Silver has continued to exhibit Bullish Cycle Phases since March 9, 2020.

Both Gold and Silver ended their last completed Cycle Phases recently. Gold will end the last completed Cycle Phase on May 10, 2021. Silver ended its last completed Cycle Phase on April 12, 2021.

The next Advancing Cycle Phase for both Gold and Silver will begin this week and next week — and will continue until July 19, 2021. After that, the Declining Cycle Phase will begin and last until late September, for Gold, and late October for Silver.

If our research is correct, we may see extended bullish trending over the next 6+ months in both Gold and Silver.

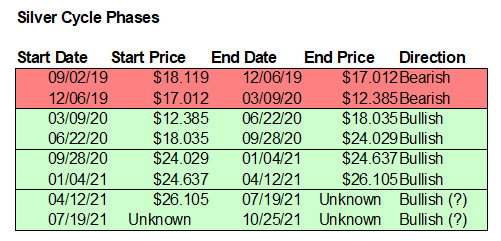

The following Silver Weekly Chart highlights the Cycle Phases and highlights the price trends for each Advancing and Declining Cycle Phase.

While Gold has experienced an extended Bearish Cycle Phase over the past 5+ months, Silver has continued to show stronger bullish price Cycle Phases and continues to attempt higher closing price levels at the end of each Cycle Phase.

We believe this suggests that Silver is likely to see some explosive upside price trending when the $28.42 level (the higher YELLOW line) is breached. This level represents historical price resistance for Silver. Once this level is breached, we believe Silver will begin to advance higher very quickly.

Remember, we have until July 19, 2021, before the first Advancing Cycle Phase in Silver ends. This Advancing Phase may prompt a move above the $28.42 level and may attempt to rally above $30.00 as we have drawn on the chart (below).

If the Declining Cycle Phase continues this bullish trend, we may see Silver trading above $32.00 ~ $33.00 before Halloween 2021. This would represent a +26.5% rally in Silver from the last completed Cycle Phase price level.

In closing, we want to suggest that a rally as we are proposing in Gold and Silver will also present a renewed risk factor for the US and global markets (potentially).

In the past, we have seen precious metals rally while the US stock market rallies. It is not uncommon for precious metals to begin to move higher while the US stock market continues to move higher.

This type of price activity simply suggests that global traders/investors are moving capital into Precious Metals as the US stock market climbs a strengthening “wall of worry”. This type of price action happened from 2004 to 2009 – prior to the Credit Crisis/Housing Crisis.