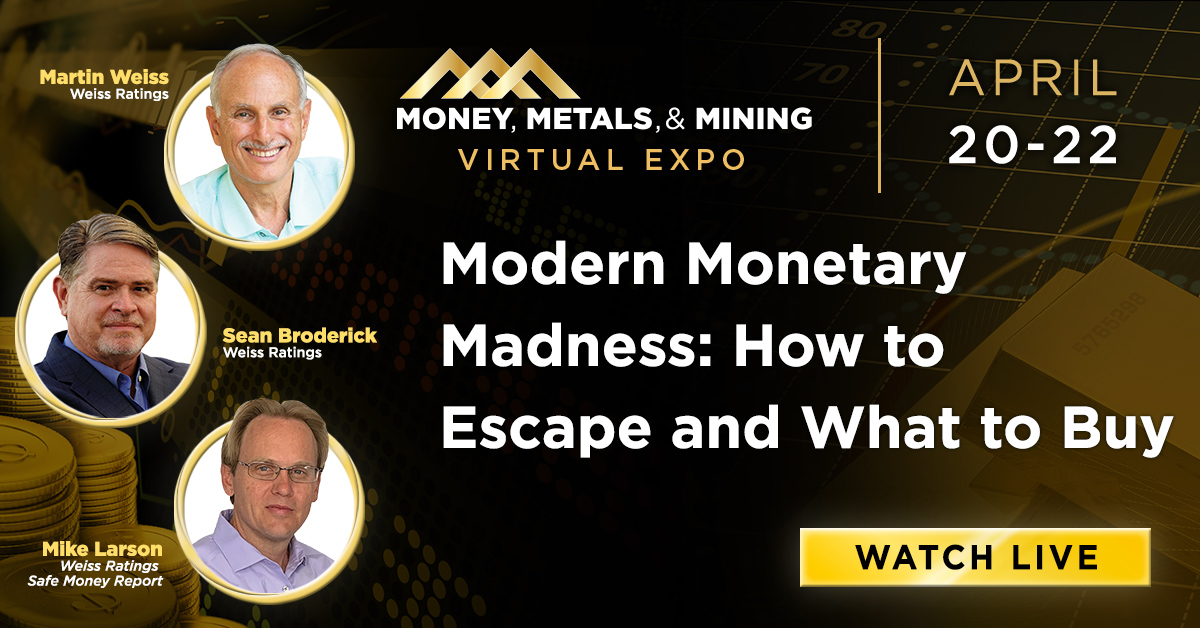

Some readers may be old enough to remember President Franklin Roosevelt’s New Deal program from the 1930s. Others may relate better to President Lyndon Johnson’s Great Society push in the 1960s, notes Mike Larson, editor of Safe Money Report — and participant in MoneyShow's Metals & Mining Virtual Event on April 20-22. Register for free here.

Now, Joe Biden is launching his own mega-plan for America. It’s one that echoes the spirit, mechanics and goals of those earlier federal efforts. But it’s even more aggressive in size, scope and cost — especially if you include the $1.9 trillion stimulus bill from early March.

The huge push will require huge amounts of debt to be sold in the capital markets. It doesn’t matter what your political bent is now. What’s most important as an investor is to capitalize on the environment we have now and will have for the foreseeable future.

I recommend you target a new, diversified global materials giant for generous income and juicy potential gains. I’m talking about Rio Tinto Group (RIO).

London-based Rio Tinto produces everything from iron ore and aluminum to copper, diamonds and titanium. It has more than 47,500 employees spread across 60 locations in 35 countries.

Among its far-flung operations are the large iron ore mining, rail transport and shipping facilities in Pilbara, Western Australia ... the Oyu Tolgoi copper mine in Mongolia ... the Argyle and Diavik rough diamond mines in Australia and Canada ... and a long-running borate mine in California, which supplies a mineral used in fertilizer, glass and home insulation.

Basic materials and commodities like these are the global economy’s building blocks. When trillions of dollars are being thrown at that economy — not just here in the U.S. but abroad as well — companies like Rio Tinto are among those best positioned to scoop it up. Lots of it.

In fact, Rio Tinto managed to report a 3% rise in sales, 6% growth in cash flow from operations and a 20% increase in core earnings last year despite the COVID-19 pandemic. That’s because materials demand and pricing rose strongly in the second half of 2020 as stimulus kicked in.

Rio Tinto couldn’t avoid business hiccups entirely. Its aluminum results weren’t as strong as I’d like to see, and currency market movements put upward pressure on costs.

But the firm’s overall outlook is solid. Net debt has been coming down. Rio Tinto’s U.S.-traded shares sport a dividend yield of almost 6%, courtesy of generous regular and special dividends (the firm pays out on a semi-annual basis). And our Weiss Ratings system upgraded the stock to “Buy” territory in December.