Regulated electric utility Evergy (EVRG) was formed in 2018 from a merger between Westar Energy of Topeka and the parent company of Kansas City Power & Light — Great Plains Energy, explains Robert Rapier, editor of the industry leading advisory, Utility Forecaster.

Evergy is the largest electric utility in Kansas, serving 1.6 million customers in the eastern half of Kansas and western half of Missouri.

The company was the highest-ranking electric utility in the recent screen I conducted to identify potential new portfolio additions. The stock has a yield of 3.7% and a payout ratio – 66%

- 5-year annual earnings per share projected growth – 6%

- 5-year beta – 0.38

- FactSet rating (average of seven analysts covering it) — Strong Buy

I view Evergy as a low-risk addition to an income portfolio, replacing some of the higher volatility holdings we just removed. Over the long term, the company projects dividend growth rates in the 6%-8% range.

Combined with a yield currently close to 4%, that gives potential annual shareholder returns in the 10% to 12% range with a risk profile that should be acceptable to most income investors.

Like many electric utilities, Evergy is in the midst of a transformation. I will reiterate my belief that the companies that are phasing out coal in favor of natural gas and renewables will be better poised for the direction the world is headed.

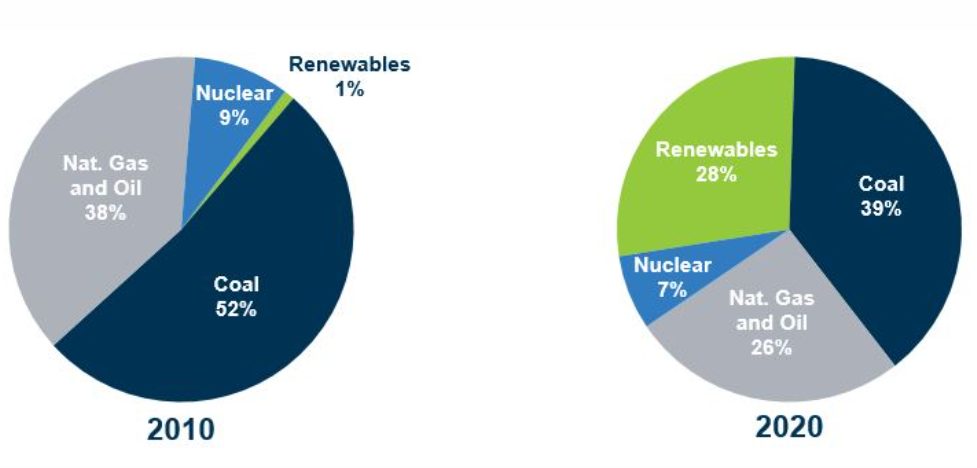

Evergy has been aggressive on this front, reducing the percentage of power they derive from coal from 52% in 2010 to 39% in 2020. They project this will be further reduced to 34% by 2024.

Source: Evergy Investor Relations

To help fund this transformation, in June 2016 Westar issued $350 million of green bonds. I make that digression just to emphasize that Evergy is serious about transforming their energy mix.

I have talked in the past about utilities that look like superstar performer NextEra Energy (NEE). Well, Evergy looks like a small version of NextEra. So much so that NextEra reportedly offered $15 billion for the company last year (a ~12% premium to the current market cap, but which was apparently turned down).

One complicating factor may be that Blackrock Advisors and Elliott Management own about 10% of Evergy between then, and a buyout would likely need their cooperation. It is doubtful that either company would accept a mere 12% premium relative to the current price.

Evergy fared well last year despite the pandemic. Adjusted earnings per share were $3.10 in 2020, compared to EPS of $2.89 in the prior year. This was at the top end of the company’s adjusted EPS guidance, and represented 7% year-over-year EPS growth. Consistent with guidance, Evergy raised its dividend 6% to an indicated annual rate of $2.14 per share.

For the two full calendar years since creating Evergy, management has reduced adjusted O&M over $250 million, nearly 20%, delivering the cost-reduction opportunity that the team envisioned and ahead of merger commitments.

If you are a conservative investor looking to add long-term income to your portfolio, you should consider a “boring” electric utility like Evergy.