After years of being threatened by so-called “robo-advisers,” traditional actively managed investment accounts are back in style, thanks to the historic bull run in stocks and increasing interest among the public as a whole, explains growth stock expert Mike Cintolo, editor of Cabot Top Ten Trader.

Benefiting from these trends is Affiliated Managers Group (AMG), an investment group with stakes in several boutique asset management, hedge fund and specialized private equity firms (including some of the best-known alternative investment management shops).

Although the company experienced net client cash outflows in Q4 (mainly from quantitative strategies and seasonal redemptions), it reported strong customer demand in the alternative investment, wealth management and specialty fixed income categories.

Collectively, these three strategies accounted for around a third of its earnings in the quarter and contributed to per-share earnings of $4.22, which surpassed expectations by 15%. Revenue of $554 million, meanwhile, was 9% above estimates. Affiliated also reported that three-quarters of its fundamental equities and alternatives strategies outperformed industry benchmarks on a five-year basis.

More important for the stock, the firm repurchased a whopping 10% of its outstanding shares in 2020, with most of those repurchases taking place in Q4; management also upped its repurchase authorization so there’s likely more buybacks ahead.

Looking forward, the top brass sees increased long-term growth prospects in light of its clients’ heightened risk appetites, with additional plans to deploy “significant capital” across its new investment pipeline.

Analysts share this optimism, forecasting top-line growth of 10% in Q1 along with a 34% bottom-line bump—very attractive given its forward P/E of 8.5.

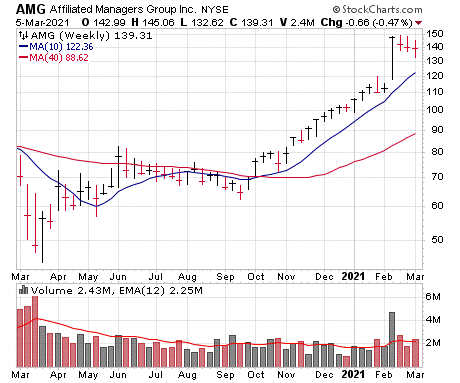

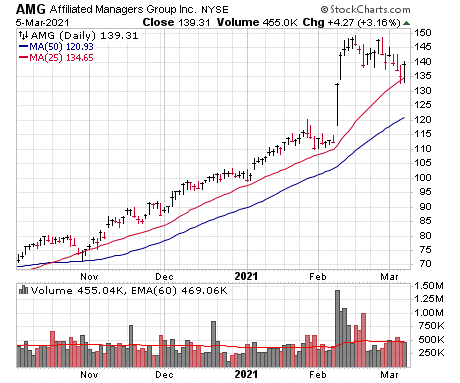

Technically, after hitting a long-term peak around 220 in 2015, AMG entered a five-year bear market. The stock finally bottomed last March at 45 and turned a corner just as the retail trading renaissance was getting started.

Affiliated Managers took its time setting up an extended base before exploding to a 52-week high in November and continued to surge into February.

Shares were overextended at that point, but we’re impressed with its resilience during the past three weeks, with the stock giving ground only grudgingly. We’re OK starting a position here or (preferably) on dips.