Investing in the healthcare medical buildings sector is a great way to generate income in both good and bad times. Perhaps one of the best spaces to find great tenants is the medical field, notes Rida Morwa, income investing expert and editor of High Dividend Opportunities.

Healthcare Trust of America (HTA) and Physicians Realty Trust (DOC) have both created very successful businesses centered around medical office buildings thanks to the high-quality tenants in the sector. HTA yields 4.5% and DOC yields 5.1%.

Doctors are very reliable with a high cash flow business that's in very strong and growing demand. Let's face it, most people don't go to the doctor for fun; they go because they have some issue that they really want resolved.

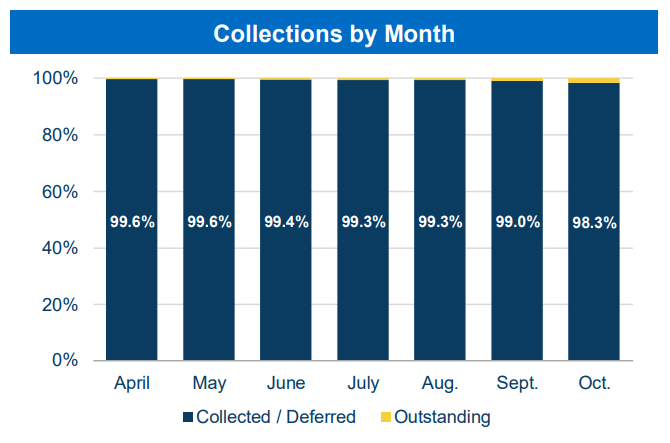

It's one thing to have a theory about how reliable a tenant is, but 2020 gave us a real-world extreme stress test. Many REITs experienced difficulties collecting all of their rent through the COVID-19 shutdowns. DOC and HTA didn't. Here is a look at DOC's monthly rent collections:

HTA experienced similar results, reported 99% rent collections in Q4 while also collecting $7.3 million out of the $11.1 million they deferred in 2020.

There's no doubt about it, medical office tenants are reliable. So next time you get a bill for a co-pay, don't get mad — look at your HTA and DOC dividends and smile.

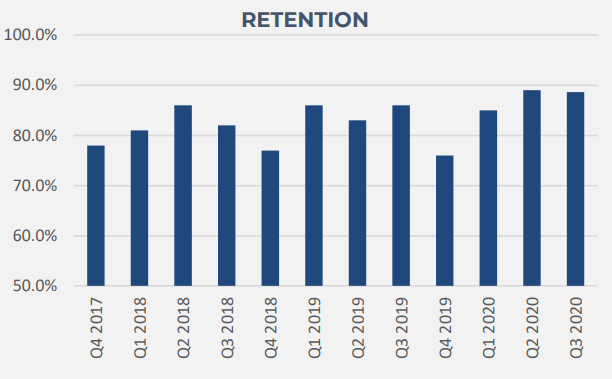

Doctors also are very attached to their locations — their customer base usually comes from people who are local and moving a practice any distance risks losing them.

For the landlords, this means a high retention rate. In other words, after an initial 5-10 year rental term, over 80% of tenants renew their lease. Here's a look at HTA's retention:

This high level of retention provides HTA and DOC with a lot of stability.

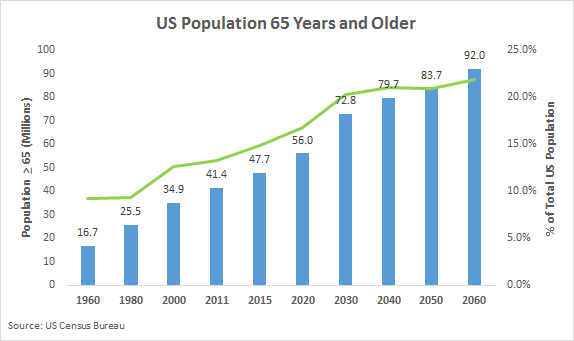

Medical demand is only going to continue to grow as the Baby Boomer generation ages. Today, there are roughly 56 million people in the US over 65 years old. By 2030, that number will increase by 30% and will account for approximately 20% of the US population.

Medical services and medical office space already is in high demand and that demand is going to continue to climb for several decades. It's a simple truth in life that the older you get, the more doctors you know on a first-name basis.

Medical office buildings have been benefiting from another trend as well. With modern medical technology, it's becoming increasingly common for people to use outpatient services, as opposed to spending significant amounts of time in hospitals. Outpatient services are precisely the types of facilities that HTA and DOC invest in.

At the end of the day, it all comes down to rent. Or in the case of investors, the amount of rent that is transformed into dividends.

HTA has a yield of 4.5% and has consistently raised its dividend for the past seven years. DOC currently pays a higher yield of 5.1% and has not had similar dividend growth.

However, we chalk this up to DOC's new acquisitions flattening as they worked to digest the flurry of acquisitions in 2016. When DOC resumes acquisitions at a meaningful level, we expect the dividend will grow to follow.

HTA is a great pick for those looking for dividend growth. DOC will provide a rock-solid dividend that will likely see growth in the future. Both companies are going to have a lot of growth opportunities over the next decade as demand for medical office space continues to grow.

Considering how reliable these REITs proved to be throughout the crisis, it's amazing that HTA and DOC are still trading below their pre-COVID highs. You can take advantage of this discount and enjoy collecting 4%-5% yield plus double-digit capital upside as their share prices continue to recover.