One sector that begins its seasonally favorable period in March is utilities, asserts Jeffrey Hirsch, an expert in seasonal trading strategies and editor of Stock Trader's Almanac — and a participant in The Interactive MoneyShow Virtual Expo on February 16-18. Register for free here.

This year we are going to look to take advantage of any seasonal weakness in February to establish new or add to existing positions associated with the utility sector.

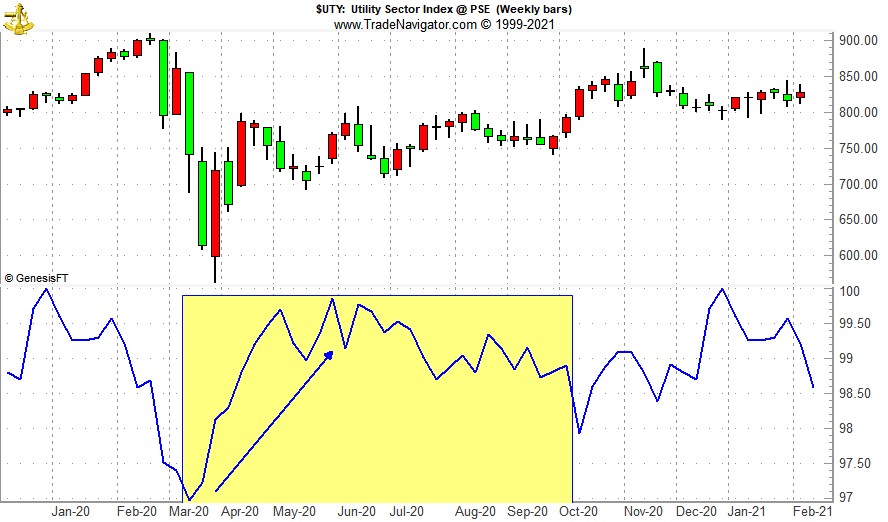

In the following weekly bar chart of the Utility Sector Index (UTY), seasonal strength (lower pane, shaded in yellow) typically begins following an early or mid-March bottom and usually lasts through early October although the bulk of the move is typically done sometime in late May or early June (blue arrow).

Last year’s volatile trading has impacted the seasonal pattern in the lower pane of the chart. Typically the pattern is less choppy as the sector does not typically experience price swings of nearly 40% in a year.

Utilities tend to be a defensive sector of the market and historically have seen gains during the “Worst Six Months,” May through October.

With over $12 billion in assets and ample average daily trading volume, SPDR Utilities (XLU) is a top choice to consider holding during Utilities’ seasonally favorable period.

It has a gross expense ratio of just 0.12% and a relatively attractive yield of 3.14%. Top five holdings include: NextEra Energy (NEE), Duke Energy (DUK), Southern Co. (SO), Dominion Resources (D) and Exelon Corp. (EXC).

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Get your FREE copy of MoneyShow’s 2021 Top Picks report here and see why the nation's leading investment experts believe these stocks will significantly outperform the market in 2021.

XLU could be bought on dips below $61.70. This is around halfway between its projected monthly pivot point (blue-dashed line in daily bar chart below) and monthly support (green-dashed line).

Based upon its 15-year average return of 7.7% (excluding dividends and trading fees) during its favorable period mid-March to the beginning of October, set an auto-sell price at $73.10. If purchased an initial stop loss of $55.53 is suggested.