The end of the year is an important time for fund investors: it’s your last chance to make tax-smart moves in your portfolio, asserts Janet Brown, mutual fund expert and editor of No-Load FundX Newsletter.

To help you keep more of your investment gains this year, FundX advisors are sharing some of what they do to help their wealth management clients at year-end. First up is managing mutual fund distributions.

Distributions start this month (in fact, two fund companies are distributing next week!), so now’s the time to get up to speed. Here’s what you need to know:

What are year-end distributions?

Stock funds are required to distribute realized long-term capital gains, short-term capital gains, and income to shareholders by the end of the year. The tax status of capital gains is based on how long the fund held the underlying security, not by how long you have owned the fund.

A gain is considered long term if the fund held securities longer than one year; otherwise it is considered short term. Long-term capital gains are preferable, as they are taxed at a lower rate than short-term capital gains. Short-term gains may be taxed at your income tax rate.

If you own funds in a taxable account, these distributions are taxable to you. (If you own funds in a tax-deferred account, you don’t have to worry about taxes, but it’s still worth paying attention to distributions, as we’ll explain later.)

When do my funds make capital gains distributions?

Most stock funds pay capital gains and income distributions in December, but a handful of companies make payouts in November. Ariel and Parnassus, for instance, are distributing next week.

Here’s a list of fund companies that usually distribute in November (we’ve linked to the fund company’s 2020 estimated distributions, when possible): Ariel, Artisan, Baron, Hodges, Hussman, Leuthold, Parnassus, and Teton.

Other fund companies, including Fidelity, Harbor, Janus Henderson, and T. Rowe Price, have made estimates available online, and most funds will post estimates in the coming weeks. Vanguard expects to have estimates available online Monday, Nov. 16. Estimates can change, but even early estimates can help you start to think about what to do in your portfolios.

What should I do if I own funds in a taxable account?

Distributions are particularly important if you’re investing in a taxable account because you’ll pay taxes on any distributions you receive from your funds, whether you’ve chosen to take the distributions in cash or reinvest them in new shares.

You’ll want to trade carefully in the final months of the year, and check to see if a fund plans to make a distribution before buying a fund this late in the year. If a fund has a distribution planned, consider whether it is paying out short- or long-term capital gains.

If you already own a fund that is about to pay a distribution, check to see what your gain or loss is on the fund. If you are holding it at a loss, or at a gain that is much lower than the expected distribution, consider selling it prior to the distribution.

You also may choose to buy ETFs, when possible, because most ETFs seldom pay out capital gains, and they typically distribute income quarterly.

What should I do if I own funds in a tax-deferred account?

If you own funds in a tax-deferred account, like an IRA, Roth IRA, or a 401(k), you don’t need to worry about the tax implications of distributions, but you should still pay attention to distributions. Here’s why: a fund’s NAV or share price drops by the amount of the fund’s distribution, so it may look like a fund has sold off sharply when in fact, it’s simply made a distribution.

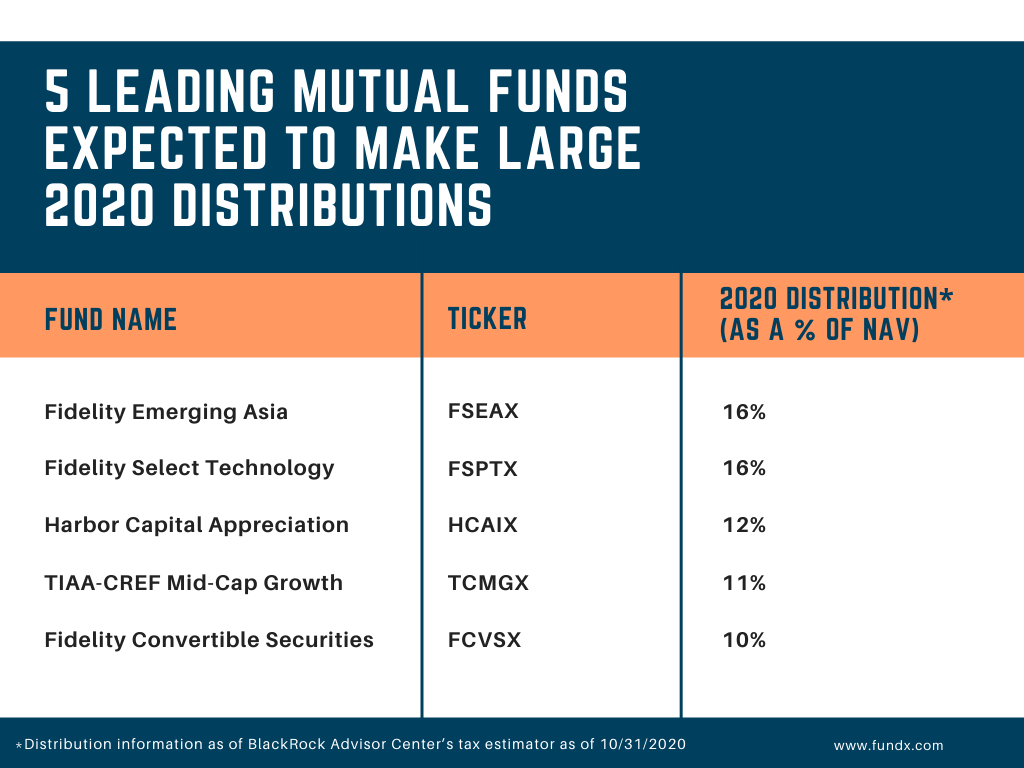

5 leading mutual funds expecting big 2020 distributions

Based on early estimates, these five highly ranked funds are expected to distribute 10% or more next month. Funds listed by estimated distribution. If you have money to invest in a taxable account, you’ll want to try to avoid buying into funds that are about to make big payouts.