To be a Dividend Aristocrat, a company needs to increase their dividend at least once a year for 25 consecutive years, explains Rida Morwa, income expert and editor of High Yield Opportunities.

Here's a look at three of our favorite Dividend Aristocrat opportunities that provide a very healthy yield today and are very likely to continue growing their dividends. These three Dividend Aristocrats are trading at very cheap prices and will continue being incredibly shareholder friendly companies.

Realty Income Corporation (O) yields 4.6%. We love receiving dividends, and there's one thing we like better than receiving our dividends each quarter and that's receiving dividends every month.

It says something about a company when they are so committed to dividends that they brand themselves "The Monthly Dividend Company." When Realty Income started, they dedicated themselves as a dividend company and that has carried through to today.

Realty Income's business model is straight forward. They buy properties and lease them to tenants with a "triple-net" lease, a type of lease where the majority of property level expenses are handled by the tenant.

Realty Income's success can be attributed to their ability to identify good real estate opportunities, limit corporate level costs and when tenants fail to pay rent, as inevitably some will, they mitigate their damages and maximize the value of the property.

Essentially, Realty Income is a landlord for a very large number of readily-identifiable tenants. Not only does the firm pay their dividend monthly, they also doubled down on the raising challenge. Instead of raising their dividend once a year, as many Dividend Aristocrats do, the REIT raises their dividend every quarter.

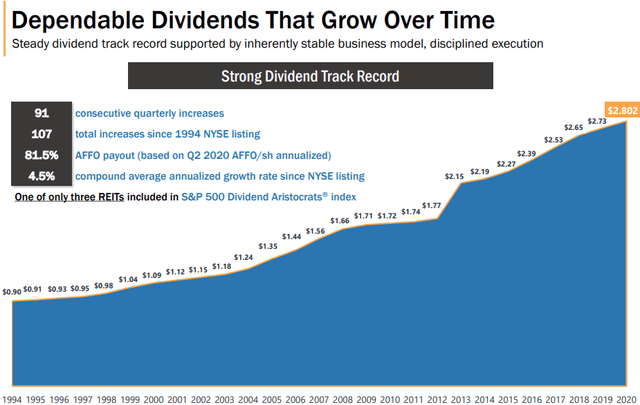

Source: Realty Income Investor Presentation

Since 1994, Realty Income has raised their dividend 107 times, an average of over four times per year. While the individual raises are small, they add up and Realty Income has averaged compound dividend growth of 4.38% over the past five years, tracking close to their 4.5% CAGR average since IPO.

Realty Income's monthly dividend history actually goes back to before they were publicly traded. They started paying monthly dividends in 1969 and have not missed one since.

Realty Income is trading at a discount today out of fears that some tenants are not paying rent. At 93.8% of rent being collected, Realty Income is doing better than their peers and more importantly the rent not being collected is heavily concentrated in two industries, gyms and movie theaters.

These are challenges that Realty Income will have to work through, but they are not significant enough to impact the long-term health of the company. Realty Income will either collect the rent or they will sell the properties and reinvest the proceeds into something else. The benefit of being a landlord is that you already own the real estate and nobody can take it from you. Some value always can be extracted.

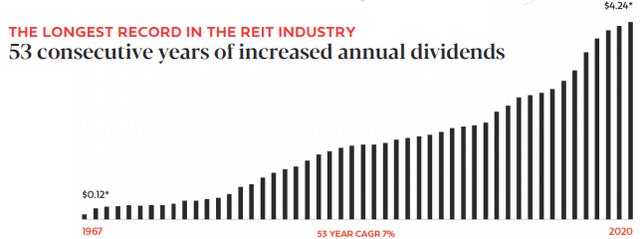

Federal Realty Investment Trust (FRT), yielding 5.5%, also is a REIT with a very impressive dividend history. FRT has increased their dividend every year for 53 consecutive years. The REIT's dividend has grown from $0.12/share to $4.24/share, with the most recent raise coming just last month.

Source: FRT Presentation

Federal Realty is a bit different than Realty Income in the types of properties they buy. Realty Income buys freestanding properties in a wide variety of locations. FRT buys strip malls, power centers and has pioneered "mixed-use" properties where common outdoor areas are used to tie together residential, office and retail uses. As a result, the firm has a very diverse tenant base.

This diversity helped limit their downside when tenants were shut down due to COVID-19. Banks, grocers, residential and office tenants continued paying most of their rent, even in April. However, they also have exposure to apparel and gyms which continue to struggle.

While 100% collections always are better, it's a testament to the enduring strength of the business model that Federal Realty was cash-flow positive even at 65% cash rent collections.

The REIT has a very strong balance sheet with an A3 rating from Moody's and A- from S&P. With plenty of liquidity on hand and the option of accessing debt if needed, Federal Realty is well-positioned to deal with delinquent tenants.

Meanwhile, its properties are in suburban areas just outside of the largest cities in the US. They have benefited greatly from populations moving from urban areas into the suburbs, a trend that COVID-19 appears to have accelerated.

AT&T Inc. (T) is a recognizable enough brand that it needs no introduction. AT&T is the Dividend Aristocrat that many love to hate. Although many like to complain about the company — about some product or =about its debt — the firm's dividend has risen steadily.

As a large conglomerate, AT&T always has a lot of irons in the fire, but the one thing that has been an identifiable headwind has been the debt that they have taken on for several major acquisitions.

Since acquiring Time Warner, T has reduced their net debt by $30 billion, and in 2020 has been taking advantage of very low interest rates to repay and refinance. These moves alone will help improve free cash flow.

AT&T currently is guiding that the dividend payout will be in the low 60%, allowing T to pay their generous dividend and still have enough left over to reduce their debt.

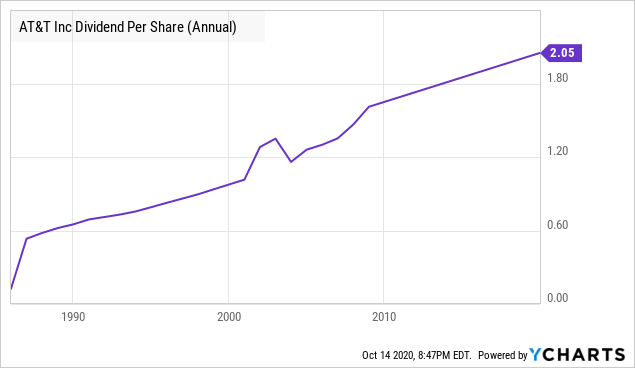

Data by YCharts

AT&T — which just reported stellar quarterly earnings — is going to continue being a Dividend Aristocrat. 7.5% is a very respectable yield on its own, and 7.5% with annual dividend growth definitely belongs in a high-yield portfolio.

Market turmoil brings opportunity. Every investor has heard "buy low, sell high" – but for many, step one is the hardest step to take.

When share prices fall, investors get scared to buy, the arguments from the bear side feel more real and imminent. Yet history has shown us that those who buy companies when they are knocked down by temporary headwinds are richly rewarded.

Income investors understand the power of cash flow, of having a strong stream of income coming into your portfolio which you can use as you see fit.

These Dividend Aristocrats provide an opportunity to not only get an immediate yield from 4.6% to 7.5%, but have also provided consistent dividend annual growth, applying the power of compounding to growing their dividends.